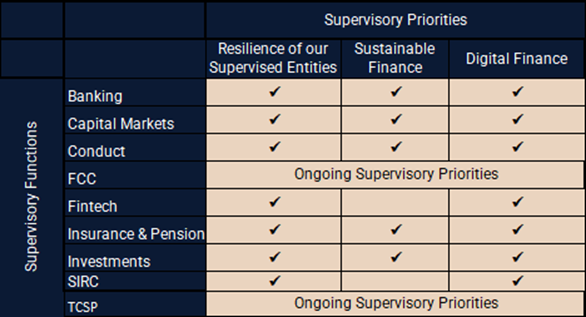

Amid an evolving financial landscape, the MFSA has identified the resilience of supervised entities, digital finance and sustainable finance as the three high-level supervisory themes to steer its focus for 2023. These themes are cross-functional, hence each supervisory function within the Authority will play a vital role in addressing these issues.

In this article, we will hear from the MFSA Supervisory Heads about how their respective teams will be contributing to one of the three supervisory themes, to ensure that the financial services industry in Malta remains resilient, sustainable and ready to embrace new opportunities.

Resilience of Supervised Entities

The stronger our supervised entities, the less vulnerable they will be to economic shocks, and their ensuing spillover effects on the broader economy.

“In the coming months, Banking Supervision will continue to monitor the resilience of business models in the banking sector, with a particular focus on risk monitoring arrangements, capital adequacy and internal governance. We will set Pillar 2 Guidance to ensure appropriate resilience buffers while continuing with Supervisory Review and Evaluation Process (SREP) assessments and communicating revised risk scores and risk mitigating requirements where appropriate. Additionally, we will be evaluating the potential impact of the revised CRD6 risk weights on banks’ business models.” Christopher Buttigieg – Chief Officer, Supervision

“We will continue prioritising applicants' financial soundness, corporate governance, and transparency to ensure their resilience. Our work will also focus on climate-related matters, the financial impacts of Russia's invasion of Ukraine, and the macroeconomic environment, to evaluate entities' continuing obligations. Additionally, we are monitoring listed entities' financial and non-financial information to ensure their transparency.” Lorraine Vella – Head, Capital Markets Supervision

“From a prudential perspective, we will focus on the compliance of investment firms with the Investment Firm Directive and Regulation through supervisory engagements to ensure that the applicable Level 1 requirements are being adhered to. We will specifically focus on capital adequacy and the determination of the K-Factors, as well as the implementation of the Liquidity Adequacy Assessment Process. Compliance with the European Banking Authority (EBA)’s Guidelines on sound remuneration policies, and business model analysis through the implementation of the SREP will also feature high on our agenda.” Doreen Balzan – Head, Investment Services Supervision

Digital Finance

The financial services industry is undergoing a significant transformation, driven by technological advancements and changing consumer preferences. Financial institutions are investing heavily in digital technologies to improve their products and services. By prioritising digital finance, the Authority will work to keep up with new industry developments to be able to effectively regulate them.

“We are responsible for the implementation of the Digital Operational Resilience Act (DORA) and its Directive. DORA comprises five main components: ICT Risk Management, ICT-Related Incidents; Testing, Managing ICT Third-Party Risk, and Information Sharing. After DORA was published in the EU Official Journal, we immediately moved to the implementation phase, which involves legal work, contributing to Level 2 texts and engaging with stakeholders. Throughout this process, we have been working alongside the European System of Financial Supervision network to ensure a smooth implementation.” Alan Decelis – Head, Supervisory ICT Risk & Cybersecurity

“We are building on the milestones achieved in 2022 by further enhancing our FinTech and Innovation offering. This includes building on the insights obtained from the 2022 Fintech Adoption Study, understanding local and international developments within digital finance, and generating more awareness and building capacity across the MFSA. During 2023, we will work to identify emerging risks and regulatory gaps when encountering innovative technology-enabled solutions in the course of our supervisory work. We are focusing our efforts on engaging with local stakeholders and assessing the readiness of current Virtual Financial Assets Service Providers to the proposed Markets in Crypto Assets regulation (MiCA).” Herman Ciappara – Head, FinTech Supervision

Sustainable Finance

The MFSA is seeking to create an environment that supports the development of sustainable financial products and services, encourages investment in sustainable projects, and fosters the growth of sustainable finance markets.

“One of the 2023 supervisory priorities for the Conduct Supervision function is the adherence to the requirements relating to the incorporation of the clients’ sustainable preferences in suitability assessments. These assessments need to be made by investment firms and insurance distributors when providing advice with respect to financial instruments and insurance-based investment products. These requirements, which came into force in August 2022, aim to ensure that retail investors can become part of the transition to a low-carbon, more sustainable, resource-efficient and circular economy in line with sustainable development goals.” Sarah Pulis – Head, Conduct Supervision

“We are increasing our scrutiny of climate-related risks and ensuring that undertakings have sustainable business models in place. We are also closely monitoring undertakings to prevent greenwashing and ensure that they are aligned with the Sustainable Finance Disclosure Regulation (SFDR) requirements. Additionally, we are issuing circulars and notices to inform the market of new developments in this area and express our supervisory expectations on the matter, including those on climate change risks. Our goal is to promote sustainable finance practices in our sector and ensure a smooth transition towards a greener economy.” Ray Schembri – Head, Insurance & Pensions Supervision