The Malta Financial Services Authority has published its latest statistical analysis of Collective Investment Schemes (CIS). This report gives an in-depth overview of the collective investment scheme industry in Malta, setting out key figures and trends covering the period up to 30 June 2021 and illustrating how this industry is evolving.

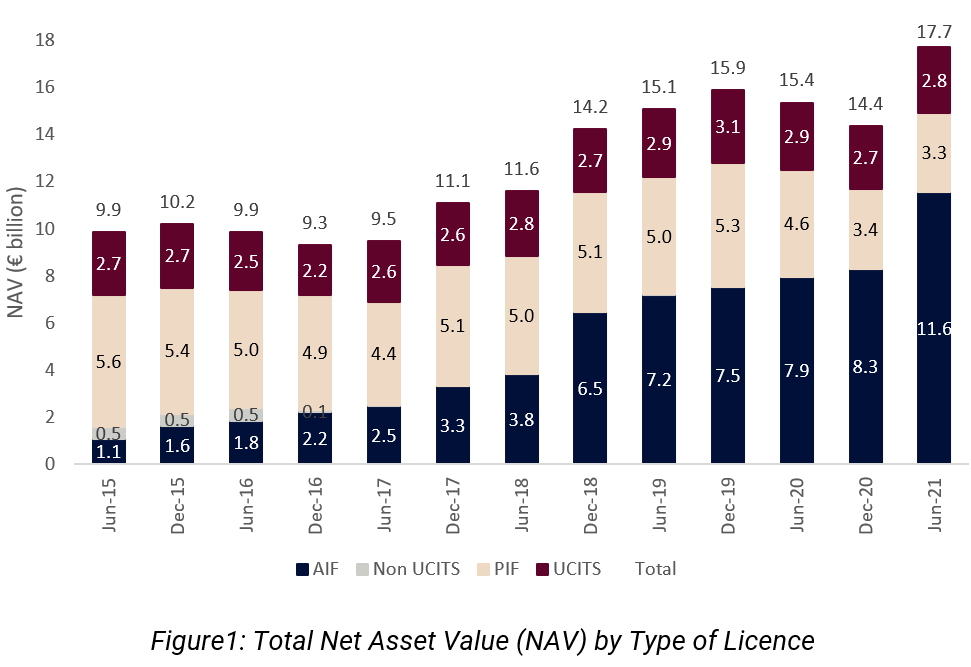

As can be seen from the bar chart below, in the period under review, the Maltese Collective Investment Scheme industry has bucked the trend and recorded appreciable growth. Indeed, the aggregate net asset value of investment funds domiciled in Malta rose by €3.3 billion to reach €17.7 billion. In percentage terms, this accounts for a positive growth of 23.4% when compared to end 2020. This growth is represented exclusively in the Alternative Investment Fund space. This indicates that the investors are likely to be foreign institutional and/or professional investors looking for the comfort of their investment funds being regulated under the AIFMD regime.

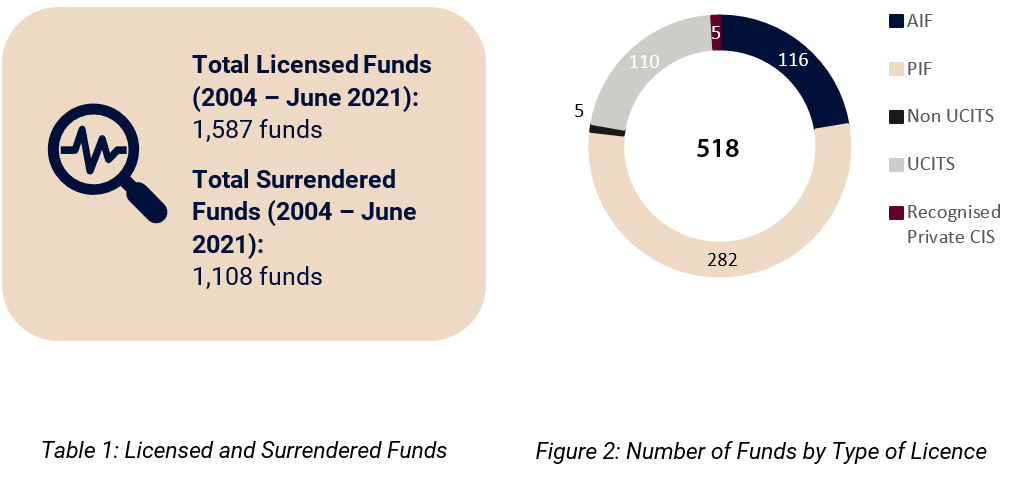

As at 30 June 2021, the number of licensed funds domiciled in Malta stood at 518, a marginal reduction of seven net licences compared to 31 December 2020. Moreover, Notified AIFs continued in their upward trend, with a net increase of 13 notifications from 31 December 2020, to stand at a total of 78 notifications as at 30 June 2021. This shows that the evolution of this product is strong, as the asset management industry is attracted by its features, not least of which is the short time to market.

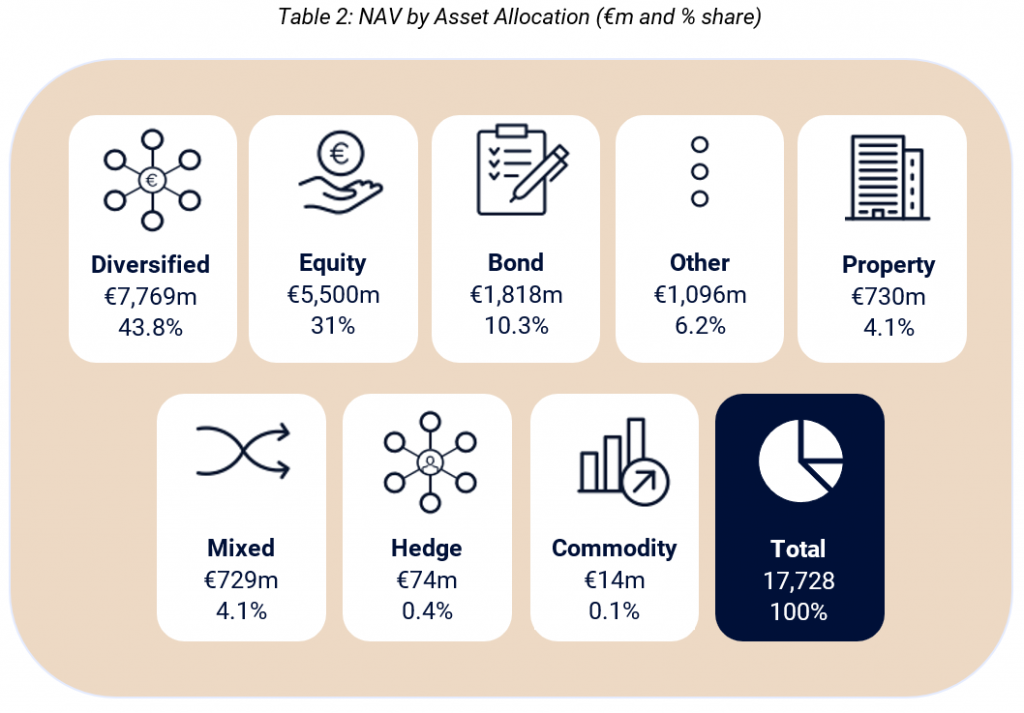

Diversified funds account for the largest share of the June 2021 NAV, followed by equity funds and bond funds. This indicates that investors seem to be attracted by the diversification in asset classes within Collective Investment Schemes. That said, investment in equity share class and bond share class is also robust and other investors achieve diversification through holding different investment funds. Investment in alternative share classes is lower when compared to equity and bond investment funds.

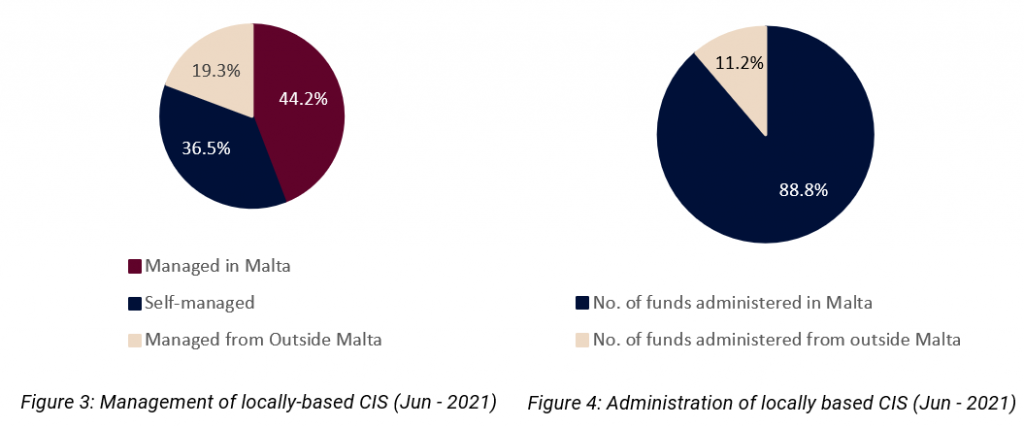

As at 30 June 2021, 80.7% of the funds were managed in Malta, of which 44.2% were managed by a Maltese third-party fund manager. The remainder are self-managed investment funds with the investment management being conducted from Malta. The balance of 19.3% of the funds were managed from outside Malta.

Domestic fund administrators administered 88.8% of the Malta-domiciled funds. Furthermore, Maltese fund administrators service a total of 218 non-Malta domiciled funds, with an aggregate net asset value of €5.3 billion.

At an international level, the number of registered worldwide, regulated, open-ended funds reached 144,410 as at the end of June 2021: an increase of 1.5% from end 2020. Net assets increased by 12.3%, from €55.2 trillion as at December 2020 to €62 trillion in June 2021. Net inflows amounted to €1.8 trillion in the first half of 2021, compared to €1.4 trillion in the first half of 2020.

At a European level, the total number of registered funds stood at 64,484 as at June 2021, up by 0.8% from end 2020. Net assets increased by 8.8%, from €18.8 trillion as at December 2020 to €20.4 trillion as at June 2021.

In conclusion, the Malta funds industry reported double-digit growth in the aggregate net asset value in the first half of 2021. This placed Malta in the highest rank in terms of percentage growth compared to other European jurisdictions in the period under review. While there was a marginal decline in the number of licensed funds, the Notified AIF segment continued to show signs of attractiveness in the funds industry recording a net increase of 20%. Indeed, the recent recorded positive trend in the Maltese Collective Investment Scheme industry is encouraging, especially when one considers the more subdued growth seen at a European level.

To view the full report click here.