During 2019, transacted property prices continued their upward trend, registering a year-on-year growth rate of 4.5% in real terms [1].

Extrapolating the current trends for 2020 would indicate a high likelihood of prices increasing further. However, given recent developments this is unlikely to occur. The COVID-19 pandemic is likely to leave its mark on the real estate market as well.

Given the relevance of the developments in the real estate market to the financial sector, due to exposures both in terms of mortgages and lending for real estate purposes, but also due to asset holdings, the MFSA has drawn on public data sources to gauge price developments in real time. [2]

The picture that emerges from these sources is that the impact of the pandemic is already being felt in the holiday rental market due to the cancellation of flights and the social distancing measures introduced during the first quarter of the year. According to AirDNA.com, there were 11,330 active listings on Airbnb for properties in Malta during the week ending 9 February 2020. This number dropped to 10,236 by the first week of June. Typically, the number of active listings is expected to increase as the summer period approaches, with more property owners opting to benefit from higher-income short term rentals during the peak season. The decline in listings suggests that property owners are opting to look for more secure long-term rentals given the uncertainty surrounding inbound tourism this summer. The properties which were removed from Airbnb listings are likely to increase supply in the long-term rental market. This increase in supply, coupled by lower demand due to a significant number of repatriations and suspension of operations in certain sectors, is likely to have significant repercussions on rental prices.

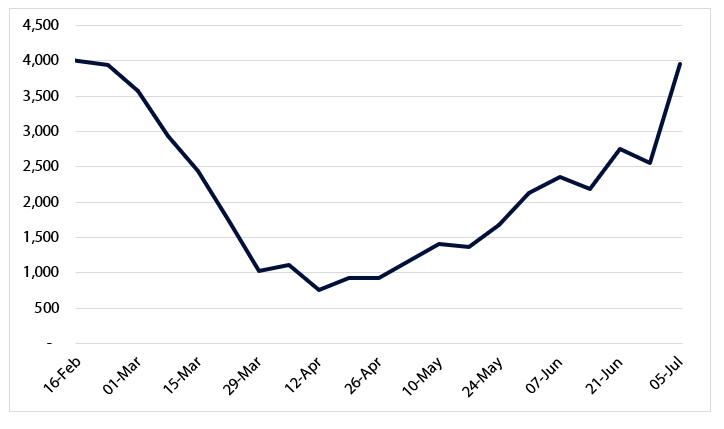

For the remaining listings on Airbnb, the season ahead is likely to be a difficult one. Figure 1 illustrates the number of new bookings each week since February 2020.

Figure 1 - New Weekly Airbnb Bookings

Source: AirDNA.com

The new bookings bottomed out during the second week of April. As the restrictions were eased, the number of new bookings rebounded, increasing notably towards the end of June/beginning of July.

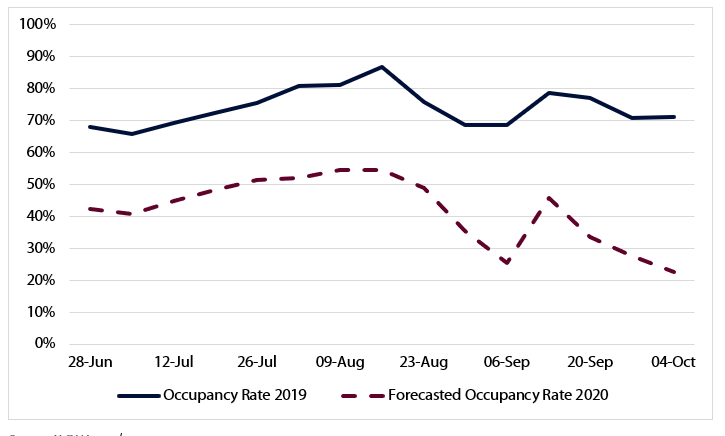

Basing on the new booking figures and assuming that such a trend is maintained in the coming weeks, it is possible to forecast the average occupancy rate over the coming months. August was the busiest month last year, with an average occupancy rate of about 80%. In comparison, current estimates for 2020 point towards an occupancy rate of about 48% during the same period. While the occupancy rate is expected to decline as the peak season draws to a close, the forecasted decline for October this year is far sharper than what was witnessed last year.

Figure 2 - Actual and Forecasted Occupancy Rates

Source: AirDNA.com

These negative prospects may, however, be mitigated by the fact that locals could be enticed to book summer breaks in Airbnb residences, particularly given the recent incentives announced by government. Nonetheless, the short-term rental market is likely to be the worst hit real estate segment, followed by long-term rental market.

Data on prices of long-term rentals in Malta are not readily available from public sources. However, to some extent, some insights could be obtained through a sub-component of the inflation index by the NSO - harmonized index of consumer prices (HICP). Looking at these high-level figures, rental prices continued their upward trend during 2019, although this trend slowed significantly during the first quarter of 2020.

To gauge a better understanding of these developments in the rental market, information was gathered from propertymarket.com.mt which brings together listings from 21 different real estate agencies. The exercise resulted in a database of over 13,000 rental listings, of which 89.7% related to residential properties. Of interest are the 2,778 residential rental listings uploaded between the 20 February and the 20 May 2020.

To gauge a better understanding of these developments in the rental market, information was gathered from propertymarket.com.mt which brings together listings from 21 different real estate agencies. The exercise resulted in a database of over 13,000 rental listings, of which 89.7% related to residential properties. Of interest are the 2,778 residential rental listings uploaded between the 20 February and the 20 May 2020.

Out of these listings, 986 listings were uploaded between the end of April and the end of May. Taking a closer look, 87.2% were new listings (unique from those listed in the previous two months), while the remaining 12.8% where either re-listed at the same price (26 listings) or listed at a lower price (approximately 100 listings, out of which a quarter were advertised specifically as “price reduced”).

Over two thirds of the listings were apartments, with an average monthly price of €1,214.57. This average figure was largely driven by the concentration of new listings in the Northern Harbour region, which has the highest average rental price across the island. This area includes several luxury developments, for example Tigne Point and Portomaso. Approximately 58% of new apartment listings were in this region, which is also the region with the highest concentration of Airbnb rentals [3].

Prices of new listings were lowest in Gozo, marginally lower than the previous average.

While the declines were most pronounced in the Northern Harbour region, overall, the average advertised price for apartment rentals was lower across the island. Looking at average prices across the island, this data set points towards a 14% decline in the average advertised rental price for an apartment in Malta, during the height of the COVID-19 pandemic [4].

These developments point towards a reversal of the consistent upward trend which has been prevalent in the local rental market over the past years.

[1] House Price Index Quarterly Data - Eurostat. [online] Available at: https://ec.europa.eu/eurostat/web/products-datasets/-/prc_hpi_q

[2] Information on short-term rentals was sourced from AirDNA.com while for the long-term rental market a database was built by web-scraping listings from propertymarket.com.mt.

[3] Ellul, R., 2019. Short-Term Rentals In Malta: A Look At Airbnb Listings. Valletta: Central Bank of Malta, p.14.

[4] For comparability, previous average figures are based on information extracted from 6,292 apartment listings made by the same real estate websites prior to the 20 of February 2020, with the listing samples sharing a similar composition.