The Financial Stability function has published a report pertaining to 2020 containing key statistics relating to the investment fund industry in Malta as well as in the European Union and globally, including a trend analysis of the registered funds, net asset value, and asset allocation. What follows is a summary of the main statistics set out and commented upon in the said 2020 report.

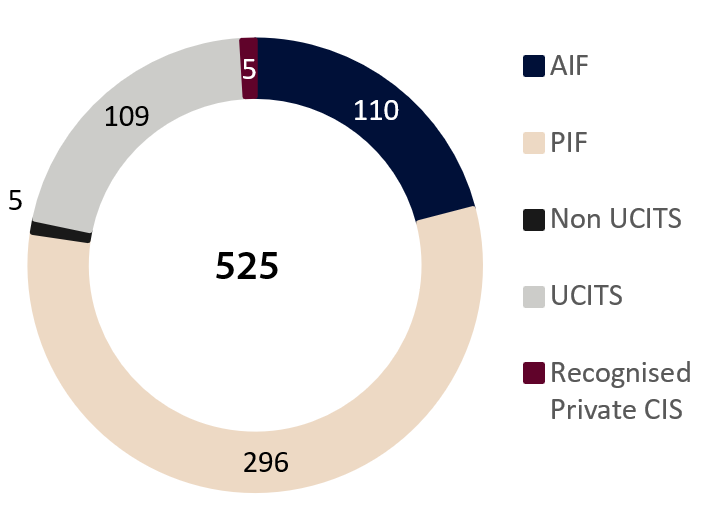

As at 31 December 2020, there were 525 funds domiciled in Malta, a reduction of 80 funds from 31 December 2019. However, funds registered in the list of Notified AIFs continued to increase in 2020, reaching 65 at the end of the year.

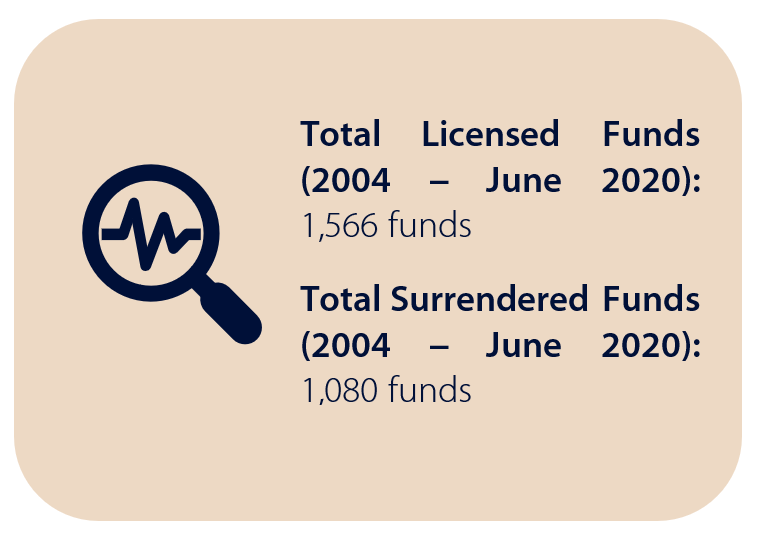

Table 1: Licensed and Surrendered Funds

Figure 1: Number of Funds by Type of Licence

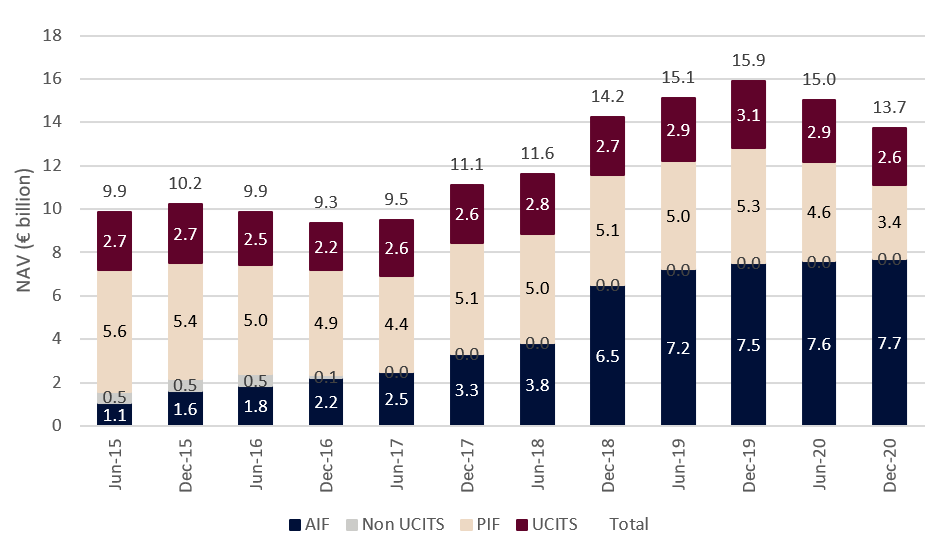

The aggregate net asset value (NAV) of Malta domiciled funds fell by 13.8 percent to €13.7 billion over the period 2019 to 2020. Alternative Investment Funds (AIFs) had the largest share of NAV at 56.2 percent followed by Professional Investor funds (PIFs) and Undertaking in Collective Investment Transferable Securities (UCITS) funds at 24.8 percent and 19 percent respectively.

Figure 2: Total NAV by Type of Licence

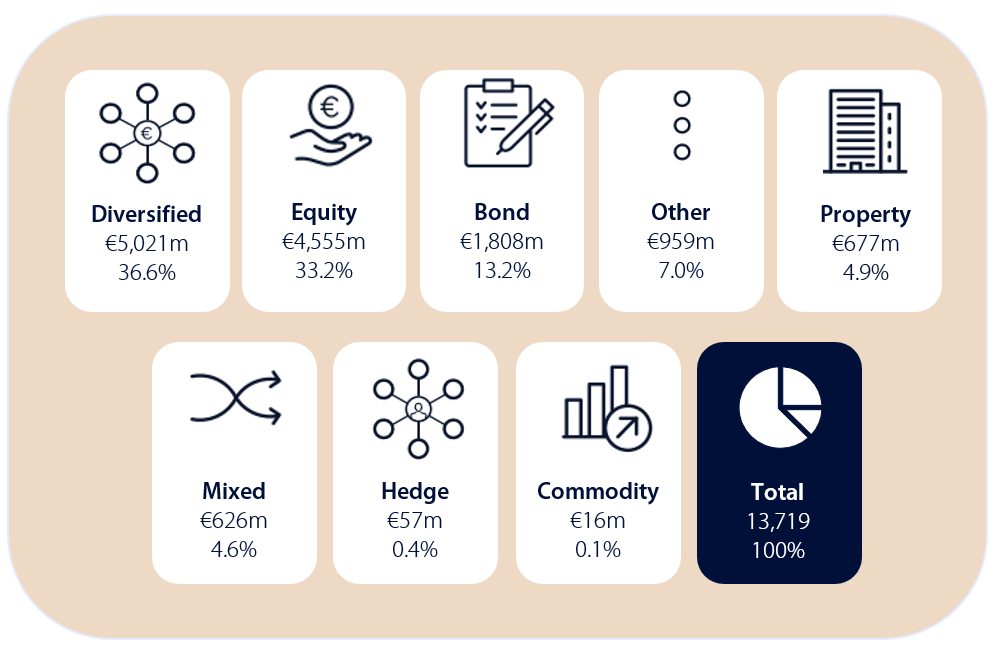

Diversified funds are the most popular type of funds followed by equity funds and bond funds.

Table 2: NAV by Asset Allocation (€m and % share)

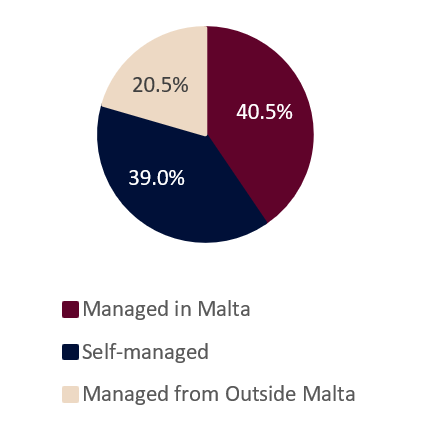

As at end 2020, 79.5 percent of the funds were managed in Malta, of which 40.5 percent were managed by a Maltese third party fund manager. The remaining 20.5 percent of the funds were managed from outside of Malta.

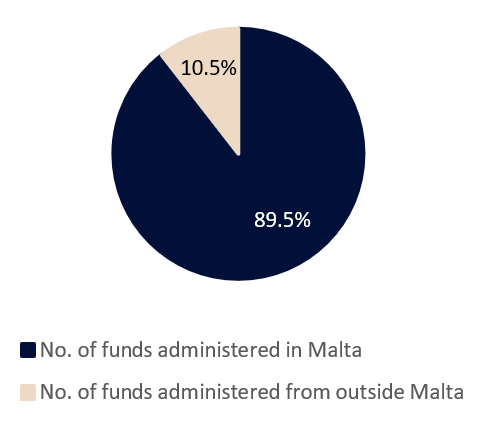

With regards to fund administration, 89.5 percent of the funds domiciled in Malta were administered by a domestic fund administrator. Furthermore, Maltese fund administrators service a total of 199 non-Malta domiciled funds, with an aggregate net asset value of four billion euros. This clearly shows that the fund administration industry in Malta is robust and strong.

Figure 3: Management of Locally Based CIS (Dec - 2020)

Figure 4: Administration of Locally Based CIS (Dec - 2020)

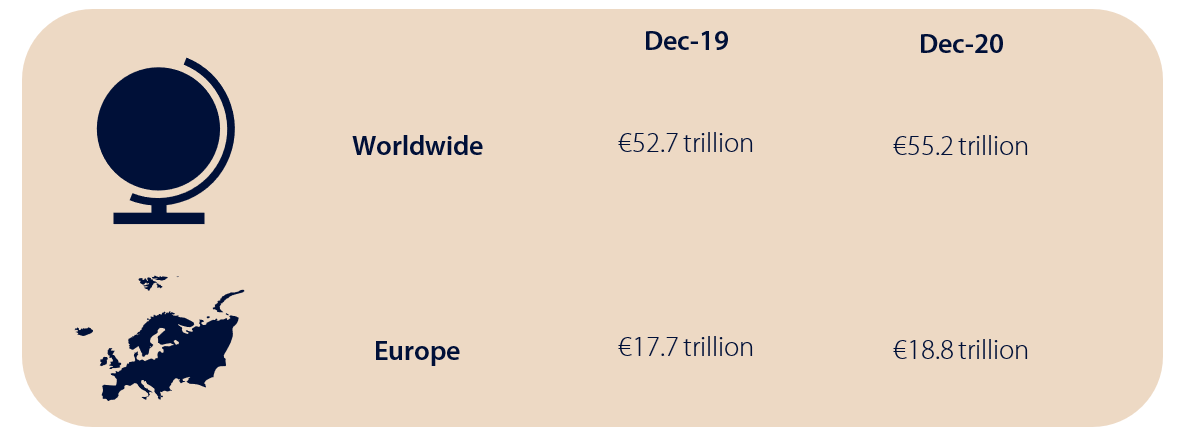

At an international level, the number of registered worldwide regulated open-ended funds reached 142,250 at end 2020, an increase of four percent from end 2019. Net assets increased by 4.7 percent, from €52.7 trillion as at December 2019 to €55.2 trillion as at December 2020. Net inflows amounted to €2.3 trillion in 2020, compared to €2.1 trillion in 2019.

At a European level, the total number of registered funds stood at 63,999 as at December 2020, up by 1.5 percent from end 2019. Net assets increased by 6.2 percent during 2020, from €17.7 trillion as at December 2019 to €18.8 trillion as at December 2020.

Table 3: NAV of Worldwide and European Funds

Source: European Fund and Asset Management Association (EFAMA)

In conclusion, the Malta fund industry has experienced reductions both in terms of the number of funds as well as in terms of total Net Asset Value, as opposed to the growth recorded by European and global fund industries. That said, the Notified AIF segment experienced a growth of 18.2 percent in terms of the number of funds during 2020 evidencing the confidence shown by the industry in this type of structure which benefits from a short time to market. On the fund servicing front, the fund administration industry in Malta continues to remain strong and a broad range of investment funds domiciled in a number of jurisdictions are serviced from Malta.