The Malta Financial Services Authority has carried out a study to obtain insight on the public’s awareness, attitudes, and behaviour towards sustainable finance and related services or products in Malta.

As Malta’s financial regulator, the MFSA is dedicated to supporting the global commitment to combatting climate change, acknowledging the crucial role which the financial sector plays in this transition. With investor behaviour evolving and ESG factors gaining prominence, the MFSA is committed to protecting consumers, promoting transparency, and addressing the risks of greenwashing, while encouraging sustainable investment practices. By conducting this latest research, the MFSA is gaining more insight with respect to consumers’ understanding of these concepts, as well as the drivers or barriers to purchasing such sustainable finance products.

Overview of Research Results

Overall, the findings reveal relatively low knowledge and awareness of sustainable finance, yet rather forward-looking interest in sustainable finance for the foreseeable future. Despite increased public interest in environmental concerns, it appears that the take-up of sustainable products and services is not yet widespread, as only a few respondents claim to have purchased such products. Limited product knowledge and consumers being tied by other financial commitments were the main reasons outlined for the lack of adoption of green financial products.

Key Findings

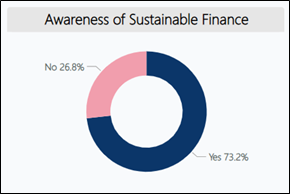

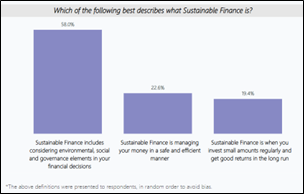

Over 70% of respondents are aware of the concept of sustainable finance, but only 58% could correctly describe it.

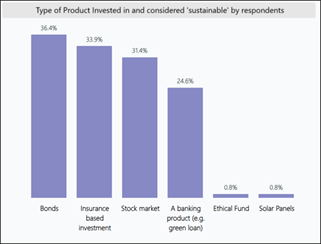

Only a quarter of respondents remarked that they have recently purchased such products, with bonds and insurance-based investment products being the two most popular options, citing ‘better returns’ as the main motivator behind their choice. When considering that just over half of respondents had correctly described the term ‘sustainable finance’, this finding suggests that many individuals do not completely grasp the concept, and as a result, may not fully understand the products they have purchased.

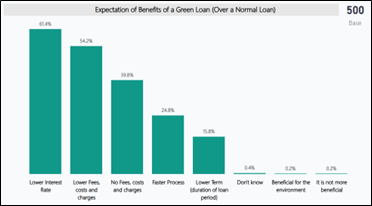

When it comes to the expectations of the characteristics of a green loan specifically, clients mentioned that they opted for these products mainly due to lower interest rates, fees and charges, while only 0.2% of respondents expect a green loan to ultimately have environmental benefits.

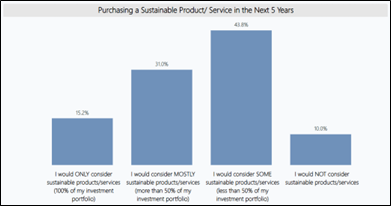

The MFSA’s study reveals that consumers’ existing financial commitments is the top barrier to purchasing sustainable finance products (41.3%), followed by another two major deterrents - lack of knowledge (40.6%) and lack of clear and useful information on the subject (31.3%). Based on the analysis of this research however, the Authority envisages that the demand for sustainable finance products/services will heavily increase within the next five years, with 90% of respondents saying that they are inclined to consider them in the years to come.

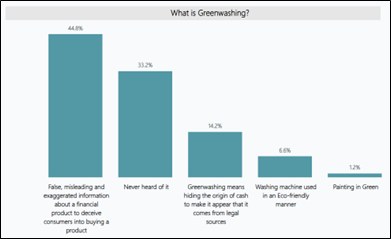

When asked about the term ‘greenwashing’, around a third of respondents remarked that they have never heard of the term, and less than half could correctly define it. This result implies that most of the respondents would be prone to the risk of misleading information, in view of their lack of knowledge.

Commenting on these findings, MFSA’s Head of Conduct Supervision Sarah Pulis said: “The relatively low level of knowledge and awareness on concepts related to sustainable finance is a major concern for the MFSA, as respondents could potentially become vulnerable to misleading information on the subject, a concept which is known as ‘greenwashing’. Sustainable finance can be rather ambiguous, especially when an investor is facing complex product features while assessing its sustainability elements. This is why we remain committed to safeguarding and protecting the interests of the public, particularly vulnerable investors who require more support and education.”

The Authority acknowledges the fundamental role that financial service providers play in bridging the gap between the investors’ fundamental values and their actual behavioural choices. When designing their financial products, financial entities are encouraged to take on board the results of this study to ensure that they are transparent, straightforward, and tailored to the needs and knowledge levels of their target markets.