Capital Adequacy

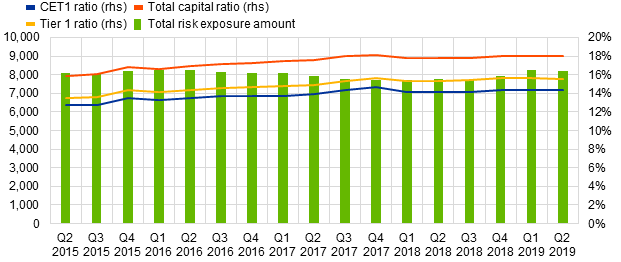

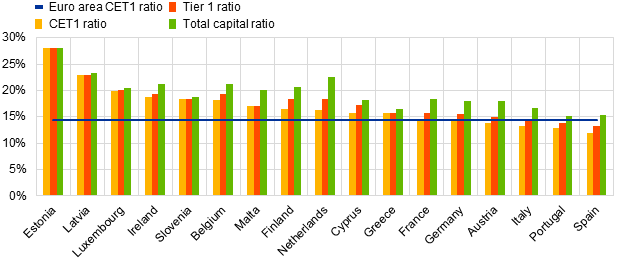

The capital ratios for the aggregated group of significant institutions, i.e. the banks supervised by the ECB, remained stable in the second quarter of 2019. The Common Equity Tier 1 (CET1) ratio stood at 14.34%, the Tier 1 ratio at 15.55% and the total capital ratio at 18.01%. Average CET1 capital ratios at participating Member State level range from 11.89% in Spain to 28.02% in Estonia.

Chart 1

Total capital ratio and its components by reference period

(EUR billions, percentages)

Source: ECB.

Chart 2

Capital ratios by country Q2 2019

(percentages)

Source: ECB.

Note: Data for some countries are not displayed either for confidentiality reasons or because there are no significant institutions at the highest level of consolidation.

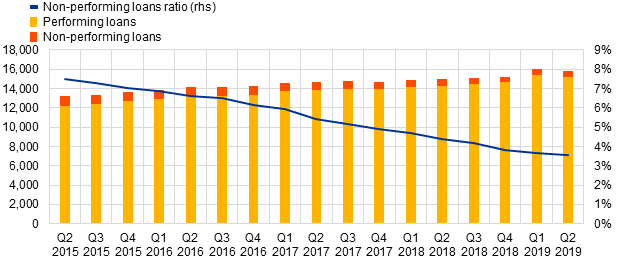

Asset Quality

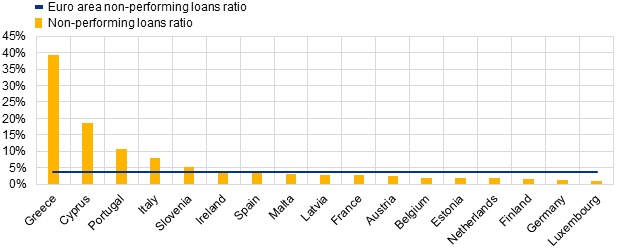

The non-performing loans ratio (NPL ratio) decreased further to 3.56% in the second quarter of 2019, which was the lowest level since supervisory banking statistics were first published in the second quarter of 2015. The lowest average ratio is 0.97% in Luxembourg, and the highest 39.24% in Greece.

Chart 3

Non-performing loans by reference period

(EUR billions, percentages)

Source: ECB.

Chart 4

Non-performing loans ratio by country Q2 2019

(percentages)

Source: ECB.

Note: Data for some countries are not displayed either for confidentiality reasons or because there are no significant institutions at the highest level of consolidation.

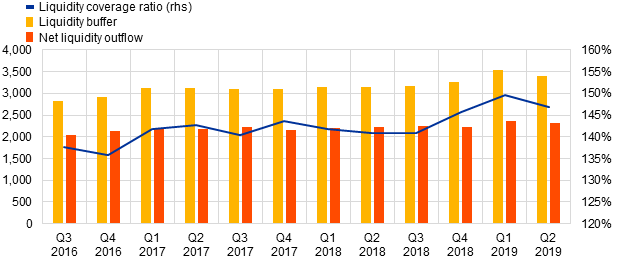

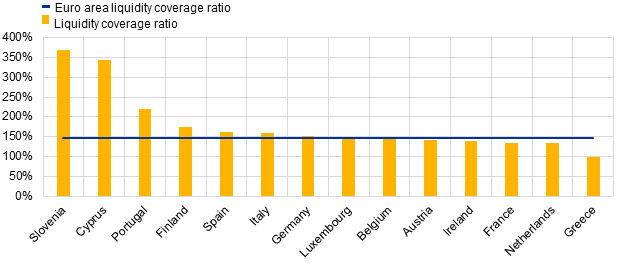

Liquidity

The liquidity coverage ratio stood at 146.83% in the second quarter of 2019, down from 149.51% in the first quarter of 2019. The average values range from 99.15% in Greece[1] to 369.16% in Slovenia.

Chart 5

Liquidity coverage ratio by reference period

(EUR billions, percentages)

Source: ECB.

Chart 6

Liquidity coverage ratio by country Q2 2019

(percentages)

Source: ECB.

Note: Data for some countries are not displayed either for confidentiality reasons or because there are no significant institutions at the highest level of consolidation.

Factors Affecting Changes

Supervisory banking statistics are calculated by aggregating data reported by banks that report COREP (capital adequacy information) and FINREP (financial information) at that point in time. Changes in the amounts shown from one quarter to another can be influenced by the following factors:

- changes in the sample of reporting institutions;

- mergers and acquisitions;

- reclassifications (e.g. portfolio shifts where certain assets are reclassified from one particular accounting portfolio to another).

Link to Press Release - Click here.