Over 50% of financial services entities surveyed by the Malta Financial Services Authority in July 2022 have taken actions towards digitisation, digitalisation, or the implementation of enabling technologies and innovations.

This was one of the main findings of a study which the MFSA carried out among 390 Authorised Entities or Persons holding a total of 472 licences. With a response rate of 95%, the study seeks to shed light on the state of digital transformation and FinTech adoption within the Maltese financial services sector.

Respondents have cited efficiency, enhanced customer experience and engagement, as well as a reduction of operational risks as the main objectives behind their adoption of digital transformation strategies. Moreover, the study revealed that the majority of those surveyed dedicate less than 25% of their operational costs towards these strategies.

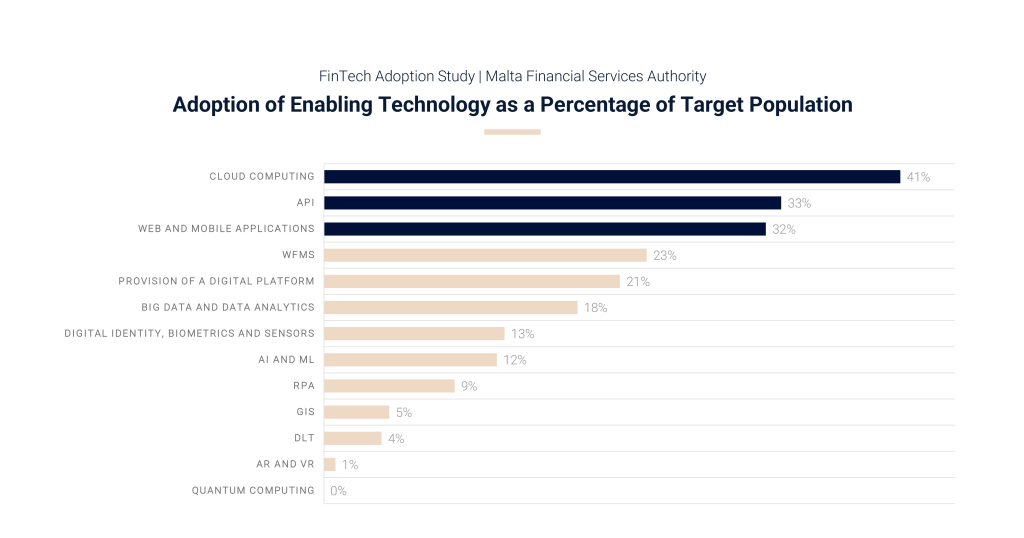

The study identified that the main enabling and innovative technologies adopted within the Maltese financial services landscape were cloud computing, Application Programming Interfaces (APIs), and web and mobile applications. Cloud computing was found to be mostly prevalent across insurance intermediaries, APIs across financial institutions, and web and mobile applications across investment funds.

The respondents noted that the net impact following the adoption of enabling and innovative technologies was overall positive, maintaining that cloud computing, big data and data analytics, and APIs had the highest positive effects on the overall financial services landscape.

A significant number of respondents have also confirmed that they make use of Regulatory Technology solutions, mostly for Anti-Money Laundering and Counter Terrorism Financing purposes.

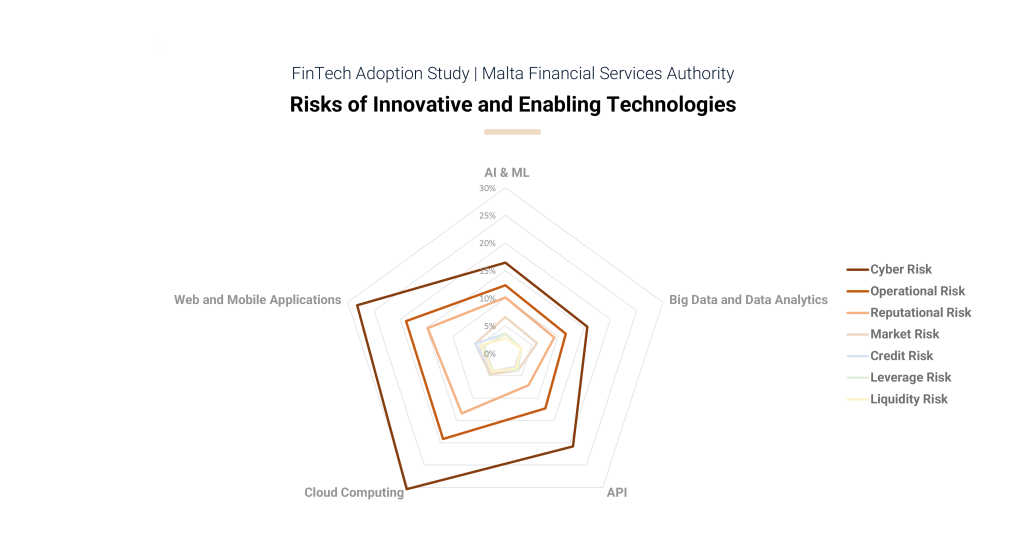

While Cyber-risk risk was perceived as the highest level of risk mostly prevalent across cloud computing, web and mobile applications and APIs according to respondents, they believed that the increase in such risk was low, indicating no immediate threats to financial stability.

Herman Ciappara, Head of FinTech Supervision at the MFSA noted: “The findings of this study will provide the Authority with the necessary insight to carry out further initiatives and supervisory engagement in this area going forward. We look forward to continue working with the industry to monitor, understand, and assess the developments and implications of the use of innovative technology and digital transformation in financial services.”

The study and a presentation outlining the main findings are available on the MFSA website. Interested parties wishing to discuss these outcomes and any other potential Digital Finance and/or FinTech initiatives should contact the Authority at [email protected].