FinTech

Regulatory Sandbox

A regulatory environment where FinTech operators may test their innovation for a specified period of time within the financial services sector under certain prescribed conditions.

Discover..

FinTech Regulatory Sandbox

Overview

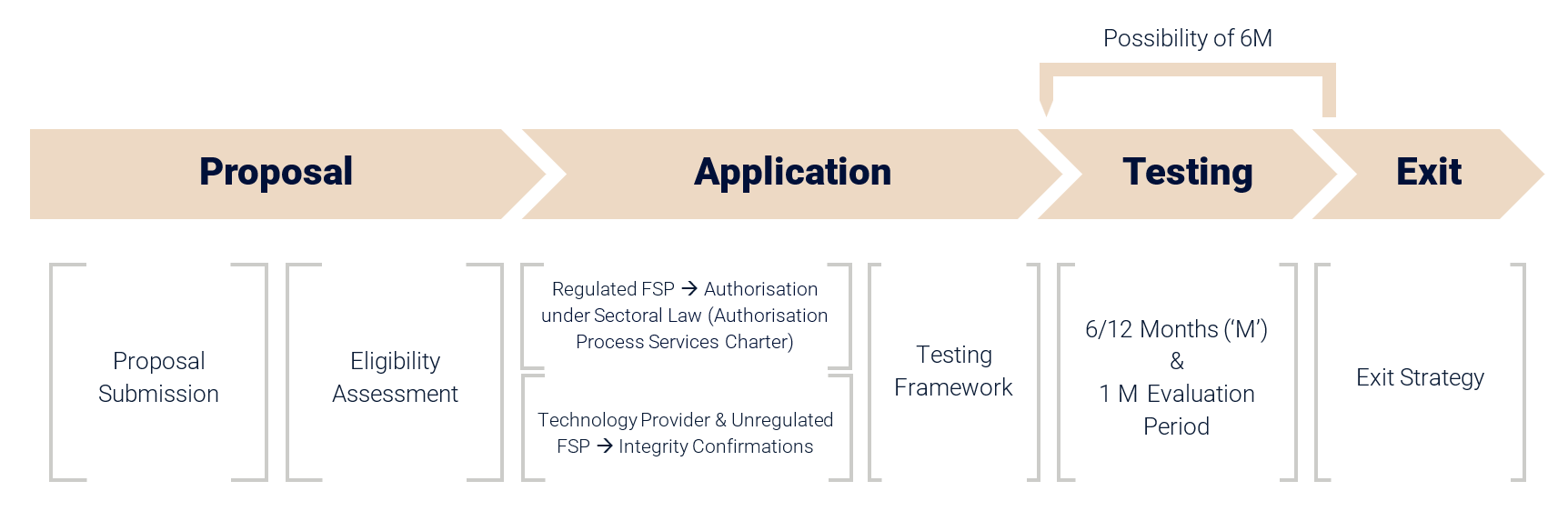

The MFSA FinTech Regulatory Sandbox (‘the Sandbox’) will provide a regulatory environment for FinTech operators to test their innovation for a specified period of time within the financial services markets, under certain prescribed conditions.

This initiative aims to encourage innovation in a sustainable manner whilst offering true value and protection to consumers of financial services. It will also act as an enabler to enhance legal certainty within the market and encourage knowledge sharing through collaboration and open dialogue.

Scope and Eligibility

The Regulatory Sandbox welcomes start-ups, technology firms and established financial services providers which endorse technologically-enabled financial innovation in their business models, applications or products.

Proposed solutions should be innovative and technologically-enabled, demonstrating a genuine need for testing within a controlled environment so that any inherent regulatory gaps and risks are identified.

Additionally, the solution must have identifiable benefits to consumers and be ready for testing with adequate resources to operate for a minimum of one year.

A valuable tool for both established financial services providers and new entrants

Regulatory Sandbox

General Overview

The Sandbox is a regulatory environment, where FinTech operators may test their innovation for a specified period of time within the financial services sectors. The aim is to support sustainable financial innovation, ensure regulatory certainty and promote knowledge sharing. These are the objectives of the Regulatory Sandbox.

Innovation

The Sandbox will provide a regulatory environment allowing technologically enabled financial innovation – new business models, applications, processes or products – to operate within the financial services market.

Sustainability

Through close dialogue, the MFSA will be monitoring Participants to observe whether their innovations truly offer value to the consumer and the wider financial services sector, whilst ensuring consumer/investor protection, market integrity and financial soundness.

Certainty

The Sandbox will enhance legal certainty within the financial services market as it provides both the Participants and the MFSA with the space to determine the appropriate requirements under the applicable regulatory frameworks.

Knowledge

Through collaboration with Participants, the MFSA will have the opportunity to enhance its capacity in assessing the regulatory implications and gaps of such solutions, and identify the appropriate response as necessary.

For a detailed understanding of the Regulatory Sandbox..

Regulatory Sandbox

Scope and Eligibility Criteria

The Sandbox is open to all persons wishing to explore technology-enabled financial innovative solutions which could result in new business models, applications, processes or products with an associated material effect on financial markets and the provision of financial services subject to the fulfilment of four (4) eligibility criteria. Such persons may be Regulated or Unregulated FinTech Service Provider, or Technology Providers.

“The Solution shall be (i) technology-enabled and (ii) innovative, resulting in new business models, applications, processes or products within the financial services sector.”

Considerations

- The Solution must clearly indicate that it leverages existing or emerging technology/ies in an innovative way to provide or support the provision of financial services.

- The Applicant must demonstrate, through market research or other means, that their Solution is different from current solutions.

- The Applicant must demonstrate that the Solution does not solely re-brand but scale-up and/or re-engineer existing business models, applications, processes or products within the financial services market.

- The MFSA has encountered few or no comparable solutions.

“There should be a genuine need to test the Solution in the Sandbox with clear outcomes in accordance with the scope of the Sandbox being to to identify any inherent regulatory gaps, challenges and risks.”

Considerations

- The Sandbox will be beneficial for the Solution being tested and that it is the appropriate regulatory approach to assess the Solution’s risks, challenges, and potential regulatory and supervisory gaps.

- The Sandbox is an appropriate regulatory approach in which they can engage with the Authority and release the Solution within the financial services market.

“The Solution should provide identifiable value added by addressing a problem or bring identifiable benefit/s to the consumers and/or financial sector; and (ii) be sustainable from an economic and financial point of view.”

Considerations

- Proposed Solution aims to provide significant increase in efficiency and user experience, and a decrease in cost compared to current products on the market.

- The Applicant must demonstrate clearly that the proposed Solution is beneficial to consumers and the wider financial services market and that they have accounted for potential negative externalities.

- The Applicant must present a thought-out plan accounting for possible risks and demonstrates that they have a suitable mitigation plan which ensures consumer protection, market integrity and financial soundness.

- The Applicant must demonstrate that the proposed Solution can be discontinued with minimal impact to consumers and the financial services market.

- The Applicant must demonstrate that the proposed Solution (i) captures an otherwise undeserved niche market; (ii) increases financial inclusion; or (iii) enhances competitiveness of the financial services market.

“The Solution should, at the time of commencement, be released or ready for release to the client and/or financial service provider and the Applicant should have adequate financial and operational resources to operate throughout the duration of the Sandbox.”

Considerations

- The Applicant should have an adequate operational capacity to operate for the foreseeable future.

- The Applicant has strong financials which indicate adequate resources.

- The Solution is ready for release to the public.

- The Sandbox Applicants should have secured the necessary partner/s through the applicable contractual agreements and/or outsourcing contract/s with one/or more authorised financial services provider/s, as applicable.

Regulatory Sandbox

Online Proposal Form

The Applicant shall submit its Proposal to the Authority through the online proposal form which will be considered by the Authority during Selection Stage in order to determine whether the Applicant falls within the scope and whether the Applicant and its Solution meet the requirements and eligibility criteria

Should you require an assistance, reach out to ...

Read our Sandbox related...

Publications

Sandbox Rule 3

FAQs

FAQs

Here you will find frequently asked questions, intended to provide answers to your potential questions regarding the Regulatory Sandbox.