Payments and Transfers

The way we pay for things might be the difference between incurring costs or saving money. It is important to consider your payment options to reduce your fees and charges as these fees can add up over time and make a dent in your savings.

Customers should be aware that apart from the framework contract which governs the relationship between banker and customer in relation to their payment account (such as savings or current accounts), other terms and conditions apply in respect of “payment instruments”.

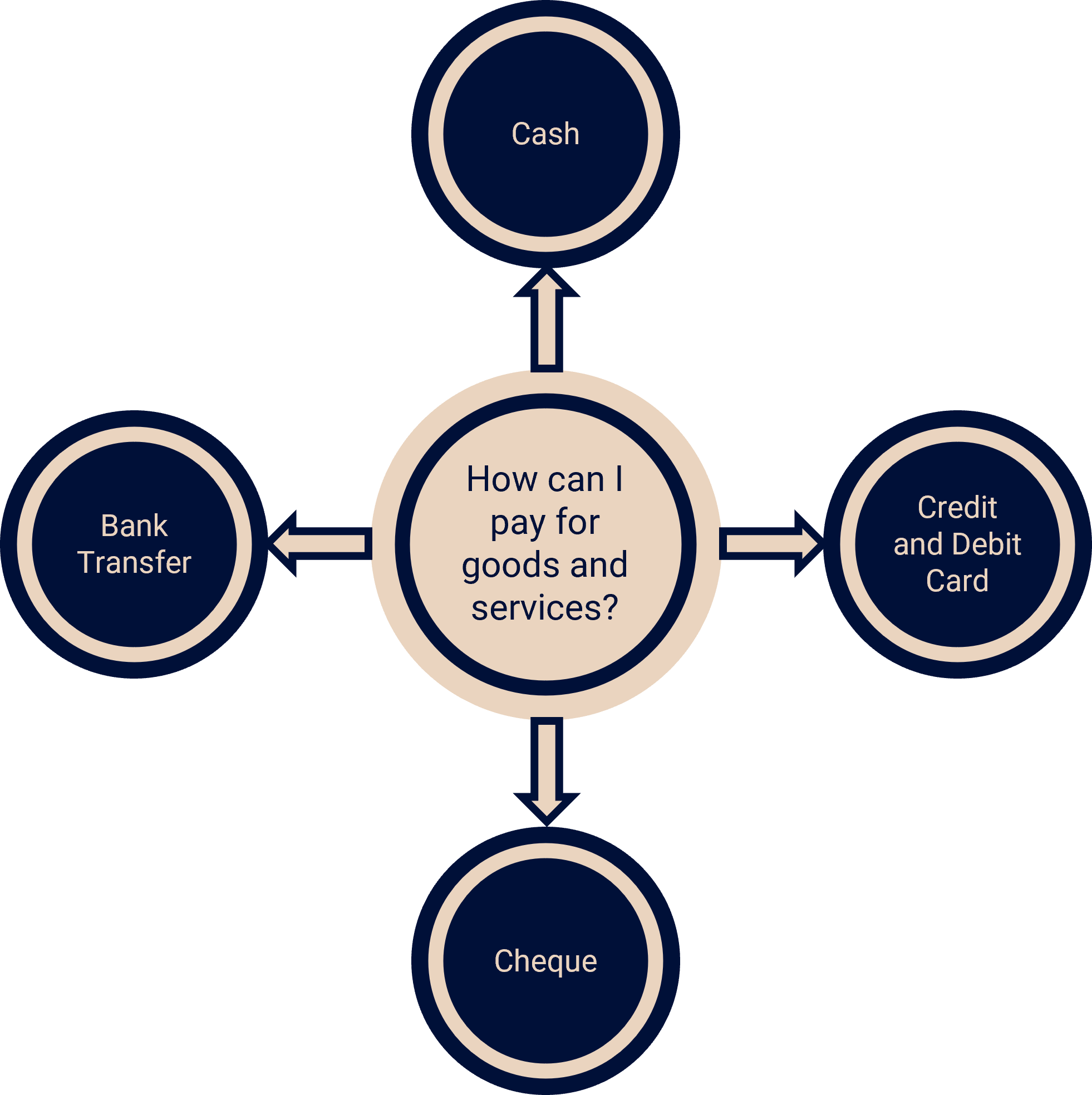

The term “payment instrument” is applied to a diverse range of forms of payment (cheques, payment cards, payment orders, etc.). In the widest sense payment instruments are all means that allow you (the user or payer) to make a cashless transfer of funds or a cash withdrawal. There are paper or documentary payment instruments, and electronic instruments, which have been created on the basis of technological developments and advanced communications. The former include cheques, or money orders, while the electronic instruments include payment cards, electronic payment orders (such as direct debits or credit transfers) and electronic money.

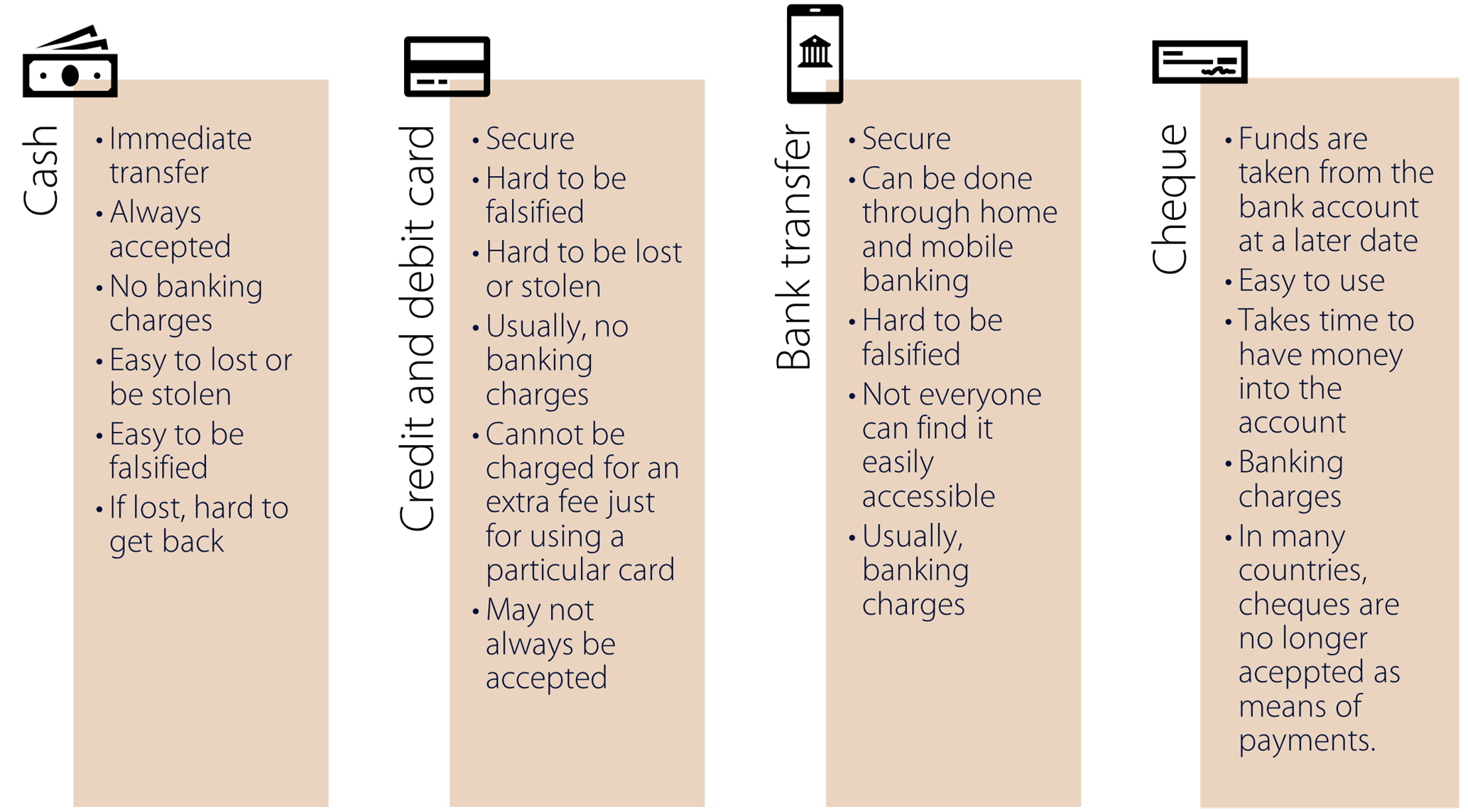

Cash

Cash is a payment method made up of coins and notes. It is a universal payment method which acceptance is mandatory.

Cash is also a means of immediate liquidity, once the payment for the good or service is provided, it is immediately received.

Is there a risk with cash?

Cash as a payment method is also subject to fraudulent activity. In fact, Central Banks worldwide encourage the use of other payment instruments such as credit and debit cards, which are increasingly practical, convenient and safe.

In addition to the above, it is important to be aware of the characteristics of existing coins and notes to be able to identify its authenticity. To learn more about this, click here.

It is not advisable to transport big quantities of coins or notes. Don’t forget that a card has your name, but cash does not, so it will be difficult to prove that it is yours if misplaced or stolen.

Also ensure that your cash is in good shape! If a note is damaged, there’s a risk of not being accepted.

Bank Transfer

A bank transfer is a way to pass money from one bank account to another. In simple terms this is when you ask your bank to send a stipulated amount from one account to another account. It is also a faster form of transaction than using a bank draft.

What is a bank transfer?

The person who requests the transfer is the payer whilst the one receiving it is the payee and the bank doing the transfer is the payment services provider. The latter can be a credit institution, payment institution or an electronic money institution.

How does it work?

A transfer can be done over the counter of an institution, by telephone, via home-banking (internet banking) or any other platform made available by your bank or financial institution.

The access via home-banking (internet banking) would only be made available if you previously requested it to the bank and if the bank had agreed to provide you the same.

Are there any charges?

Charges vary with different forms of transactions and may also vary amongst institutions depending on the way the transfer has been requested. The receiving bank may also charge a fee for incoming payments. You are likely to pay lower charges if you order a transfer through the bank’s internet banking service. Higher charges may be applicable if you order a transfer through a bank branch. You may find more information on the charges of the institutions in their respective websites or public facilities.

Do you know?

Your bank must charge you the same fee for payments in euro across the European Union as it does for equivalent transactions carried out in Malta. This includes:

- Transfers between bank accounts in different EU countries

- Withdrawals from ATMs in EU countries

- Payments by debit or debit card across the EU

- Direct debit transactions

Bank Draft

A bank draft, also called a bank cheque, is a payment instrument that involves a document issued by a bank guaranteeing that the amount stated on the draft will be paid to the recipient of that draft.

It is used as a type of cheque which is more reliable and secure than a personal cheque as it is endorsed by the bank itself on behalf of the payer, ensuring that the person receiving it will receive the money.

How does it work?

To obtain a bank draft you should go to your bank, and after processing your request and carrying out some necessary checks will issue it.

First, the bank will check your account to make sure the funds are available for transfer. Having verified this, the bank will transfer the money from your account to the bank. This is what makes this payment instrument more reliable than other forms of payment as the bank already has the money that will be paid out and the document is backed by a financial institution.

The draft is then issued and handed to you. Afterwards you can deliver it to the seller or recipient.

When is a bank draft used?

The bank draft can be used in foreign countries to make a payment or close a transaction. You can have one prepared in the currency of your choice.

On the other hand, the person who’s being paid by bank draft can deposit it at any financial institution, exactly as if it were cash. Since the funds have been guaranteed by the issuing bank, the payee (person or entity receiving the draft) is sure to receive the money indicated in the draft.

Can I stop a bank transfer?

If you change your mind and decide not to buy the item in question, or the seller decides to call off the transaction, you can have the bank draft refunded to you. To do this you should simply visit your bank with the unused bank draft.

What currency is used to transfer funds in the EU?

All banks throughout the EU (including Malta), are obliged to process transfers in Euro and EEA* currencies at the latest by the end of the next business day at no additional costs. This also applies if you are sending/receiving payments from or to an account held with a bank in the EEA*. If your request is made through a bank branch (rather than electronically through internet banking), the bank may delay the process by a further one (1) day.

*The European Economic Area (EEA) includes EU countries, and also Iceland, Liechtenstein and Norway. It allows them to be part of the EU’s single market.

Safe Transfer of Funds

What do I need to look out for to ensure a safe transfer of funds?

When requesting a transfer, you would need to indicate the following:

- the amount in the currency of the transfer;

- the name and the IBAN (International Bank Account Number) of the beneficiary;

- the bank account details of any correspondent bank, if applicable;

- the purpose for which payment is being made;

- the subject for the payment is stated.

Are there any charges involved in case of an error?

Your institution may charge you additional fees if you do not provide a correct or full IBAN. Compensation may be payable if the institution of your choice does not keep to its stipulated time limits or does not comply with the instructions it receives.

Always ask the institution for more information.

What do I need to watch out for when transferring funds?

The institution is only obliged to process a payment on the basis of your instructions. It will NOT verify if the beneficiary is genuine. Once the transfer is processed, your bank will not be able to amend your instructions or cancel/reverse the transfer.

Receiving money from abroad

Depending on the bank of your choice, you may be charged a flat fee (depending on the amount you receive) or a percentage of the amount received, subject to a minimum or a maximum threshold. Some banks may not charge you if the amount is below a certain amount.

What do I need to know and check for when receiving money from abroad?

- Keep in mind that if funds are credited in an account of a different currency, the bank will apply an exchange rate to convert the amount.

- If you are expecting a payment from abroad, you should provide the sender of the funds with:

- Your details (name and address);

- Complete and correct name of your bank (and branch, where applicable);

- Your IBAN (International Banking Account Number). It is likely that these details are already printed on your bank account statements but if in doubt, check with your bank;

- Amount in the currency of the transfer.

Understanding your bank’s list of charges

When sending money by bank transfer, you will be charged either a flat fee or a percentage of the amount, subject to a minimum or a maximum.

What type of charges are they?

You should always check about such fees prior to committing yourself to the service, either directly with your bank or through its tariff of charges.

Other additional charges may also apply:

- other transmission charges: usually a flat fee which is usually applied when sending payment in particular currencies;

- same day value payments: usually a flat fee if you wish funds to arrive on the same day when the bank remits them;

- Non Straight-Through-Processing (STP): usually a flat fee is added when you do not provide your bank with the IBAN and BIC.

Keep in mind that:

- if you choose to pay all fees yourself (“OUR”), any fees charged by the beneficiary bank will be debited from your account. Your bank might not be able to tell you how much such fees could amount to at the time of the transfer.

- if for any reason funds are returned to you, you might incur exchange charges if funds may need to be converted to the original currency. Make sure you discuss this with your bank.

SEPA

The Single Euro Payments Area (SEPA) is an initiative of the European banking and payments industry in order to allow customers to make payments in Euro throughout Europe as easily as they do within their own countries.

Where is SEPA available?

SEPA eliminates the differences when dealing with national and European payments.

Besides the countries in the Euro area it also allows for non-Euro European countries to apply the Regulation to their national currency. To-date, it applies for Sweden and Romania.

Under SEPA, when you make a cross-border payment in euros, Romanian lei and Swedish krona within the EU, your bank can’t charge you more than it would for an equivalent national transaction. Even banks based in EU countries outside the euro area must apply this rule.

What type of transactions are available?

The transactions included are:

- transfers between bank accounts in different EU countries;

- withdrawals from cash machines/ATMs in EU countries;

- payments by debit or credit card across the EU;

- direct debit transactions.

Example: if your bank charges you 1 EUR each time you withdraw money in your home country from a cash machine outside your bank network, they must charge you the same amount when you make a withdrawal in another EU country.

A SEPA payment would therefore be national or international payment, for which the account of the remitter (the person sending the money, the sender) and of the beneficiary (the person who is receiving the money) are held in one of the 28 EU Countries or in Norway, Iceland, Liechtenstein, Switzerland and Monaco (all SEPA countries) and is denominated in euro, Swedish krona or Romanian lei.

What other requirements are needed?

Other requirements for SEPA transactions are:

- payments must meet the STP (Straight-Through Processing) criteria. This means that the payment instructions must contain the IBAN of the beneficiary bank;

- all transactions shall use the shared (SHA) charging option. This means that the Remitter pays his/her bank charges and the Beneficiary pays his/her bank charges;

- Transfers in euro and EEA currencies shall be processed at the least by the end of the next business day at no additional costs. If the transaction is made through a bank branch (rather than electronically through internet banking, where available), the bank may delay the process by a further one day;

- Banks of beneficiaries of funds shall value date and make available the amount of the payment transaction to the payee’s payment account at least by the following day after they received the funds in good order (i.e. processed using correct IBAN and on SHARE basis).

IBAN

What is an IBAN?

The IBAN (International Bank Account Number) is a code attributed to every bank account to identify it in national or international payments. It is created having as basis the BBAN (Basic Bank Account Number) adopted in each country, preceded by the respective country code and 2 digits of control.

As an example, in Malta it is made up of 31 characters: the first two are always the letters MT, which stand for Malta, followed by 84 and the BBAN. In Germany it is made of 22 characters and the first four are always the letters DE (Deutschland) and the digits 89.

Is the IBAN number the same as the account number?

The IBAN does not replace the account number given to you by your bank. It is a way of representing your bank’s account number in an internationally recognised standard format.

Where can I locate my IBAN?

You can locate your bank’s IBAN (as well as your BIC – see below) on your account statement. Contact your bank if you cannot locate your IBAN. Some banks’ websites offer the facility to generate your IBAN online. You should quote your IBAN in any correspondence and invoices especially when expecting payments from other banks. Providing your bank’s BIC is optional for payments in euro. Providing the BIC for other currencies (such as GBP sterling) remains mandatory.

An IBAN generated by a local bank is made up of 31 alphanumeric characters. It will split as in the following example:

| Country Code | Check No. | Bank and Sort Code | Account Number |

| MT | 84 | MALT01100 | 0012345MTLCAST001S |

Therefore, the number you should look for on your statement should look something like this: MT84MALT011000012345MTLCAST001S.

You can find additional information on the Malta Bankers’ Association website.

What is BIC?

BIC (Bank Identifier Code), or the SWIFT code, is made up of both letters and numbers and helps to identify one bank from another. Providing your bank’s BIC is optional for payments in euro but for other currencies (such as GBP sterling) it remains mandatory. For a comprehensive list of BICs of banks authorised in Malta and abroad you can refer to the BIC Code Search website. The website requires you to choose the country in order to see the list of the entities authorised and then obtain the relevant BIC Code.

Cheques

A cheque is a written instruction to your bank to pay a specific amount of money in a specific currency from a bank account held in your name with that bank.

The person issuing the cheque on a current or cheque account is the drawer, instructing the bank (known as the drawee bank) to pay a sum of money to the payee on the cheque.

What is the criteria needed to write out a cheque?

To write a cheque you need to:

- be an account holder and have the bank’s authorization to make payments by personal cheque;

- deposit a specimen signature at the bank so that it can check the signature on the cheque is authentic;

- have enough money in your account to cover the cheque. Issuing a bad cheque has serious consequences.

Does the bank check the authenticity of the signature on the cheque?

To check whether the signature is authentic, the bank compares it with the specimen signature deposited on a special form on the day the account with the bank was opened.

Does a cheque have an expiry date?

Normally, cheques are valid for six months unless otherwise stated on the cheque itself. A cheque is considered as stale if more than six months have elapsed on the issuance date.

Are cheques considered as legal tender?

Cheques are not legal tender – if you owe someone money, that person is not obliged to accept a cheque. Instead a creditor is entitled to be paid in legal tender and can refuse payment in any other form.

What type of cheques are there?

- Customers’ cheques

Issued by customers, should preferably be deposited into an account of the payee. However, if cheques need to be encashed these should be presented at the branch where the account is held.

- Bankers’ Draft

Also known as Cashiers’ Cheque or Bank Cheque. It is a cheque written by one bank drawn on itself, making it more acceptable to a payee as means of payment. The issuing bank guarantees that it will pay the payee when the cheque is presented and cleared. A bankers’ draft is issued at a fee.

Can a cheque be issued without availability of funds?

A bank can only honour payment on an issued cheque if there are funds available in the account. Otherwise the bank will not affect the payment and the cheque will be sent back to the payee with the words “Refer to drawer”. In this case a cheque is dishonoured or ‘bounces’ and is considered by the bank as unauthorised borrowing. The bank will charge the drawer a fee for informing him/her about any unauthorised borrowing. The drawer’s account may also be charged interest for the time the account is overdrawn.

How can I make a Stop-payment of a cheque?

You can exercise this facility when you want to stop the payment of a cheque is lost or which is believed to be stolen. In such a case you must:

- Inform in writing the branch where your account is held; and

- Ensure that your branch has clear details which correctly identify the cheque you wish to stop.

You can also bar the payment of a cheque using internet banking, if your bank provides such a service. If your cheque book has been stolen, you need to phone your bank’s 24- hour call centre immediately.

What are the reasons for a cheque not being valid?

A bank will not normally impose a charge if a cheque is returned unpaid for the following reasons:

- Absence of an endorsement;

- Irregular endorsement;

- Payment is countermanded;

- Cheque is torn;

- A bank stamp is required;

- Cheque is wrongly listed;

- Drawer is deceased.

A Code of Conduct drawn up by the Malta Bankers Association and endorsed by some local commercial banks encompasses the banks’ duties to customers and third parties in respect of cheques and cheque handling. This Code of Conduct can be downloaded via this link.

What to watch out for?

Cheques are a tempting target for criminals to steal money or goods from the drawer, payee or the banks. Banks encourage their cheque account holders to be vigilant and thus prevent cheque fraud. It is imperative that whilst writing a cheque, measures are taken to make it difficult to alter it after it is drawn.

What are the types of cheque fraud?

- Counterfeit cheque: it is printed on non-bank paper to look exactly like genuine cheques and are drawn by a fraudster on genuine accounts;

- Forged cheque: a genuine cheque that has been stolen from an innocent customer and used by a fraudster with a forged signature;

- Fraudulently altered cheque: a genuine cheque that has been made out by the genuine customer, but a fraudster has altered the cheque in some way before it is paid in, e.g. by altering the beneficiary’s name or the amount of the cheque.

Keep in mind…

- Never accept a cheque, or bank draft from someone, unless you know and trust them.

- Be especially wary when accepting a high–value cheque (e.g. if you are selling a car).

- If a cheque turns out to be stolen, fraudulently altered or counterfeit, the bank has a right to reverse or reclaim any amounts credited to your account.

- It is safer to ask for payment for high–value items to be made by other means (as an internet banking payment or a bank transfer). However, there may be charges in settling the transaction in this manner. If the “buyer” is unwilling to pay the relatively small cost involved – or to split it with you – then you really do need to be on your guard.

- Scams involving cheques may also involve the fraudster offering a cheque or bank draft for significantly more than the price of the goods. As ever, anything that sounds too good to be true should set alarm bells ringing, but the fraudster’s excuse may sound plausible. This type of scam may involve the seller being asked to transfer the amount of the overpayment either to the fraudster, or to a third party after three days when, it is claimed, the cheque will be cleared. It is likely that the cheque or banker’s draft is fraudulent. The banks do all they can to spot and stop such cheques and drafts in the clearing system. However, with this scam, the cheque might not be genuine. The paying bank will therefore return the cheque unpaid and reverse any funds placed in an account. If the customer has already made the overpayment to a third party (usually by means of a money transfer service), he will end up losing out financially (and the fraudster bagging an amount of money fraudulently).

- A bank draft is not necessarily safe from fraud. They can be stolen or altered like any other cheque, and if altered, stolen or counterfeit they will not be honoured. If you receive a bank draft in payment for goods, you should wait until you have certainty that the draft has been cleared. Only after you obtain such certainty from your bank should you release any merchandise.

- Keep your chequebook in a safe place, report any missing cheques to your bank immediately and always check your bank statement thoroughly. Ensure to write the details of the cheque on the stub to facilitate reconciliation.

- Fraudsters target cheques where there is any unused space in the payee line. This type of fraud means there are no signs of obvious alteration, reinforcing the importance of drawing a line through all unused spaces when writing out a cheque.

Where can I get more information on cheques?

It is imperative that account holders are knowledgeable of their obligations regarding the operation of their accounts as formulated in their contractual relationship with their respective bankers. Usually the contractual relationship is referred to as the General Terms and Conditions.

Direct Debit

A Direct Debit is an agreement between you and a service provider (such as a telephone service provider) giving permission to the service provider to withdraw money from your bank account.

How does it work?

In this agreement, you authorise the service provider you want to pay to collect an amount (which may be variable or fixed) from your bank account (even an overdraft facility) on a periodic basis or as a one-off payment without any further action on your part.

Once you have agreed to the contractual terms of a Direct Debit, the money will be deducted automatically.

How do I determine the time of when funds are withdrawn?

A Direct Debit can be set up to pay out on a stipulated date every month, on a quarterly or yearly basis.

The service provider will give you 14 days prior notice of the amount and date of collection (unless there is a bilateral agreement to the contrary).

If the service provider you are paying wants to change an amount or date of collection, it is obliged to inform you before it affects any changes.

Authorising a service provider to collect payment from your debit or credit card is not a Direct Debit.

What is SEPA?

The SEPA Direct Debit (SDD) is the technical definition of the European direct debit and allows any client located in the SEPA to pay through direct debit, in Euro, from one bank account and applying the same rules. It shall feature on your statement next to the amounts of your direct debit bills.

When you pay utility bills by SEPA debit transfer you can ask for a refund within eight weeks if the amount is higher than expected based on your spending habits and the terms and conditions of the contract. As for the other payment methods, the new European regulations provide that payments can be contested within 13 months of the due date if not authorized (i.e. if the SDD agreement had not been signed).

What control do I have over a direct debit payment method?

With a Direct Debit the date or payment amount can be changed by the service provider you are paying. Some banks and service providers charge for a Direct Debit.

As a client, you should control your direct debit authorizations, by:

- verifying if all the authorizations correspond to what you agreed with the creditors;

- verifying if the values charged correspond to the amount due;

- defining a date from which you don’t authorize more direct debits for a certain entity;

- limiting the maximum amount an entity can charge for a certain DD authorization.

Direct debits are usually given for an unlimited period of time and can be charged by the client.

What happen if a direct debit is erroneously processed?

Banks have in place technologies which avoid this. However, it may happen that a payment is made by mistake or the wrong amount is taken – for example if you cancelled a contract with a supplier, but the direct debit was still made after the contract was terminated. In these situations, you have the right to get a payment refunded within 8 weeks. This applies to all direct debits, both within Malta or cross-border direct debits within the EU.

Standing Orders

Standing Orders are a way of setting up a regular, fixed payment from your bank account.

How does it work?

You can set a payment to be withdrawn at a certain frequency (for example, the 1st of each month; or every quarter etc.) for a fixed amount.

You can only setup a Standing Order with your bank. It is not possible to setup a Standing Order with a service provider (unlike a Direct Debit).

The bank pays the amounts from your account automatically on the agreed dates, after which it transfers them to the person’s or organisation’s bank account you are paying. You must inform your bank if the amount or the dates of payment need to change.

What are Standing Orders used for?

Standing orders are typically used to pay rent, a life insurance premium or other fixed regular payments. As the amounts paid are fixed, a standing order is not usually suitable for paying bills such as credit card or electricity bills.

Check out and compare the differences between a Standing Order and Direct Debit:

The main difference to a Direct Debit is that you are the only person who can change the date or payment amount whilst on your Standing Order, these details can be changed by the service provider you are paying only if you have been given advance notice to this effect.

Two payment services …at a glance

| Standing Order | Direct Debit | |

| Setting up service directly with the bank | Yes | No |

| Setting up service with a service provider | No | Yes |

| Amount collected may be changed by the customer | Yes | Yes |

| Amount collected may be changed by the service provider | No | Yes, depending on the agreement |

| Fee for the service | Yes | No |

| Date when amount is collected may be changed by customer | Yes | Yes |

| Date when amount collected may be changed by the service provider | No | Yes, so long as the customer is given advance notice |

| Right to claim a refund | No | Yes |

| Immediate full refund of monies following a claim | No | Yes |

| Period of time from date of payment collection when you can claim a refund | No right to claim a refund | Eight weeks, if authorised under mandate.

Thirteen months if transaction was unauthorised. |

| Right to cancel | Yes, but only through the bank | Yes, by requesting bank or service provider |

Electronic Money

Electronic money (e-money) is a digital alternative to cash. It allows users to make cashless payments with money stored on a card or a phone, or over the internet.

Emerging technologies: electronic money

Money has lost its physical characteristics to be able to travel fast through the web, but research is pushing even further ahead: special devices that scan fingerprints, eyes and face shape or voice recognition systems are able to offer new payment methods that are even more practical, quick and secure.

EU rules on e-money aim to facilitate the emergence of new, innovative and secure e-money services, to provide new companies with access to the e-money market and to encourage effective competition between all market participants

What is e-money?

The general definition of electronic money is a monetary value represented by a claim on the issuer, which is:

- stored on an electronic device (e.g. a card or computer);

- issued upon receipt of funds in an amount not less in value than the monetary value received; and

- accepted as a means of payment by undertakings other than the issuer.

What is the difference between hardware and software products?

In the case of hardware-based products, the purchasing power resides in a personal physical device, such as a chip card, with hardware-based security features. Monies are transferred by means of device readers that do not need real-time network connectivity to a remote server.

Software-based products employ specialised software that functions on common personal devices such as personal computers or tablets. To enable the transfer of monies, the personal device typically needs to establish an online connection with a remote server that controls the use of the purchasing power. Schemes mixing both hardware and software-based features also exist

Transferring Money from One Bank to Another

What do I need to check out before sending money to another bank?

Before sending money to an account in another bank (whether located in Malta or elsewhere), you should ask your bank to give you the following information in writing:

- the value date: day in which funds are to be credited to the account of the beneficiary’s institution once you order your bank to execute the transfer. The bank will be able to give you such an indication once all the information which you give to the bank is complete and correct (see below).

- the method of calculation of any fees and charges which you will be requested to pay. If possible, the bank may also be able to give you an indication of the fees charged by any correspondent and beneficiary’s banks if such fees are to be paid by you (“OUR”);

- the exchange rate used if you need to convert funds from one currency to another;

- details of any complaint procedures should the service fail to meet your expectations.

Debit and Credit Cards

Cards are payment instruments that allow its users to make many transactions, including withdrawing money, paying services and doing money transfers. Usually cards are linked to deposit accounts and are issued by credit institutions, payment institutions or other financial institutions.

Although cards are a comfortable payment method, it is important to note that merchants are not obliged to accept it as a mean of payment.

Institutions can issue different types of cards, being the most common Debit, Credit and Pre-Paid Cards.

Do you know?

When you use your debit or credit card to pay in shops and online within Malta or in another European country, the bank cannot charge you extra fee just for using a particular card (for example, whether the card is a Visa or a Mastercard). The bank can still apply currency conversion fees in case you’re paying in EU currencies other than euros.

Debit Cards

This type of cards is always linked to a current/savings account. It is one of the most used means of payment used to make transactions from the accounts.

Debit cards allow its users to withdraw cash, effect payments of goods and services and transfer money.

Anytime a client uses the debit card, the money will immediately be removed from his/her account, reducing the balance of the account.

Credit Cards

Credit cards allow you to make payments in Malta and abroad but the money spent is not immediately withdrawn from your account. In practical terms, when you use this type of card you are taking a loan from the Bank, that is borrowing you money to be repaid at a later stage.

The amount you use shall be repaid to the bank in one of the following ways:

- repaying the entire amount on a given day, or

- paying it back in fixed instalments for a certain period of time. In this option the bank will also charge you interest.

Credit cards have a pre-established limit (plafond) agreed between you and the card issuer. For this reason you will be allowed to use the card until that specific limit.

Not everyone is entitled to have a credit card and not everyone should have one. Before applying for one and starting using it, consider that:

- you’ll always have to pay a certain amount related with the amount you used in the previous period

- if you don’t pay the amount established, you may pay fees and interest

- it is better not to spend immediately and save a few months to buy something than contracting a debt to do so.

Pre-paid cards

Prepaid Cards are payment cards that are pre-loaded with a fixed sum of money. When a prepaid card is used, the money is deducted from the amount originally loaded onto the card, unlike a debit card or a credit card where the money is taken from a bank account or from a line of credit.

This type of card is very used because it is safer: in case of loss, theft, or fraud only the money still credited on the card is at risk, as the card is not linked to any account.

Prepaid cards are also particularly well-suited to young people as the amount they can spend is limited. There is also an annual limit to each card.

Having a card…

To have a card you need to establish a contract with the institution issuing it (which can be a credit institution – bank – or other type of financial institution).

The contract contains the terms and conditions to use the card, as well as the related costs (fees) and your rights and duties. You should always read carefully all the rules and information about the card and, if after reading those you still have some doubts, clarify them with the institution.

If the card you are acquiring is a credit card, you should also receive information about the interest rate being charged and how the repayment of the value used would be done.

A person over 18 years old can apply for a credit card. Your bank as the card issuer will carry out a credit scoring exercise to assess whether you are eligible for such a card.

If you are under 18, you may qualify for a credit card if you are an additional cardholder. For example, a member of your family (your mother or father) may have a credit card in their own name and the bank issues a card to you as an additional or ‘supplementary’ card holder. However, the main cardholder remains liable for all amounts owing, including any losses from a supplementary cardholder’s negligence.

Before applying for a credit card there are some questions you should ask yourself:

- Do I need a credit card?

- Will I be able to afford it?

- Will I be able to meet the monthly payments?

- If I decide to apply for a credit card what should I look for?

- What are the charges applicable on the card that I am aiming to choose? What is the relative APR (Annual Percentage Rate)?

- What is the annual fee?

- Are there any interest free periods?

An institution cannot send you a card if you did not requested it. If you received any credit card that is not for you or that is addressed to you but you did not request, go to the institution and give it back.

The Annual Percentage Rate (APR)

The APR is an indication of the total cost of credit to a cardholder, expressed as an annual percentage of the amount of such credit. The total cost of the credit is not only the interest rate applicable on your credit limit, but includes any initial or annual fees.

The APR assumes that you will spend the credit limit in full on local purchases, at the start of the agreement with the bank and that repayment is made in 12 equal instalments inclusive of interest.

It does not include penalty fees and other fees which you may be charged if you don't settle your bill on time neither the charges if you use the card abroad or when you withdraw cash from an ATM. The APR does not apply to debit cards.

Choosing between cards

With a credit card, you are borrowing money from the bank. If you don't wish to incur debts, a debit card may be suitable for you. It is safer than carrying cash around and the amount in your bank account is basically how much you can afford to spend!

Before you opt for a credit card, consider whether a credit card will be an occasion to spend beyond what you can afford. You may postpone paying with a credit card, but in the end you will have to pay your bill. The more you delay paying, the more interest you will be charged on any outstanding balances.

A credit card allows you to postpone the payment and allows an interest-free period (a period in which interest is not charged if you pay your balance in full by the due date) which is written down on your statement. The interest you will be charged if you postpone payment.

Advantages of debit cards

- It frees you from carrying any cash or cheque books and are more accepted than cheques;

- You won’t need to show your identification or giving out information at the time of the transaction;

- You can use them when travelling abroad (if it is an internationally recognised card);

- You will be able to make online shopping from some entities;

- You will not pay any interest on debit cards as is the case with credit cards.

Disadvantage of debit cards

- To use it and make payments or withdraw cash you need to have that money available in your bank account.

Advantages of credit cards

- Credit cards can enable you to build a positive credit history and that can enhance your ability to seek a future personal loan or a home loan;

- You will have cash available in the case of an emergency;

- Automatic record keeping and reconciliation through statements viewable through internet banking;

- It allows you to do online shopping;

- Combining many purchases into one payment.

Disadvantages of credit cards

- Credit cards may be easy to get but not so easy to manage;

- You should also be careful with:

- Impulsive spending increases;

- Temptation to overspend;

- Purchases of non-essential items;

- Misuse of the card which can lead to problems with your bank tarnishing your credit history.

Chip & Pin

According to PSD2, all face-to-face and online transactions need to be authenticated by Strong Customer Authentication (SCA) using two of the following authentication measures, unless they fall within an exemption.

- Knowledge (something only the customer knows) – like a password or PIN.

- Possession (something only the customer has) – like a mobile or card.

- Inherence (something unique to the customer) – like a fingerprint or their behavioural data.

Chip and PIN cards are compliant with PSD2 provisions. Instead of signing you can enter a secret four-digit PIN. Until all cards in Malta are chip and PIN, you would be able to pay for your goods or services either by signing to confirm payment (the process we are accustomed to) or entering the PIN at the trader’s terminal.

Some banks may only allow you to confirm payment by PIN, if your card is “chip & pin” enabled.

Where will the chip be and how can you know if your card has one?

Your card shall have a chip. The chip is buried inside the card but what you can see is the silver or gold coloured square on the front left-hand side of the card. There will be occasions when the person accepting your card for payment, whether in Malta or abroad will not be able to process a PIN transaction and you will be required to sign instead. Your card shall therefore retain its magnetic stripe and signature strip on the back. You might also be requested to present an identity card or passport to identify yourself to the vendor.

How does it work?

You will use your PIN card wherever you pay by card. The card shall be inserted in a PIN pad, and you just need to input your personal identification number for the transaction to go through. If you enter the PIN correctly, the system will confirm the transaction and you will be given a receipt.

Please remember that no one except you shall know your PIN. This includes retail or bank staff.

Some tips related to chip and pin cards:

Signature: Although your card has a chip, it is still advisable to sign on the card’s reverse, as the signature will continue to be used for verification in certain situations (e.g. travelling abroad to a country where chip and PIN is not used or where the retailer has not upgraded to chip and PIN).

The PIN: If you consider that you might have difficulties remembering the PIN defined by your bank, you can change to a number that is easier for you to remember. This change can be made at a cash point or by calling your bank. Your bank can also allow you to change the PIN at your ATM.

If even that way you have difficulties remembering your PIN, rather than learn it digit by digit, learn the pattern that you need to trace on the keypad with your fingers.

Know your charges

You should always be aware of the charges that a Bank can impose when using your card: to withdraw money from an ATM, to make payments, to replace it etc. The fees vary depending on the type of transaction, there are some cards that charge an annual fee. If you have a credit card, you must pay off a minimum amount each month by a set date. If you miss a payment, there may be a penalty charge.

Be aware that most of the Banks will charge you to withdraw cash using your card from an ATM in Malta or abroad and such charges may differ between a debit and a credit card. It is most likely that your bank will impose a flat fee or a fixed percentage on the value of the withdrawal. In addition, some banks start charging interest straight away if you withdraw with your credit card.

The Currency Conversion Fee (or Overseas Transaction Charge)

If your bank bills you in euro and you have used your card in any Member State where the euro is the national currency, your bank will reduce the balance of your account in the amount of the transaction with no additional charges.

However, if you have used your card in a country where the euro is not its national currency (such as the UK, USA or Canada), your bank is likely to charge a currency conversion fee (or overseas transaction charge) that will be separately disclosed on your card statement with each foreign purchase. The same charges may apply when buying on-line.

If your bank charges such a fee, check your card’s terms and conditions for more information as to how and when it is applied. It's wise to find out what are the fees attached to your card before you leave for your travels so that you will be able to budget your spending abroad.

To make an informed decision on the type of card that you may apply for and to get exposure to the whole picture of tariffs which might be imposed by the major banks in Malta, click on the section “Compare fees & charges”

Helpful tips

Your card and pin

- Sign the card as soon as you receive it. Memorise the pin. Never write the pin on the back of your card or keep the pin in your wallet. You may be risking big-time if you include your pin with your contacts on your mobile.

- Make sure you keep your card safe and destroy the pin upon receipt. Don’t ever tell anyone your pin or write it down.

- Many banks invite you to change your pin to any number of your choice. However, don’t choose a number which, with some trial and error, anyone would be able to guess it (such as your birthday).

- Keep a photocopy of your cards (front and back) in a secure place at home. You may find the photocopy useful if your bank is investigating unauthorised use of your card by other persons.

- Never lend your cards to others.

- Card numbers, PIN and other financial identification details should never be sent in an e-mail message.

- Settle any credit card bills monthly and if possible avoid accruing bills because interest is charged on any outstanding amounts. If this is not possible, you should ensure that the minimum repayment amount displayed on the statement is paid on time.

- Save your bank’s 24 hour number. If you find that your card has been lost or stolen, you have to call the bank straight away and notify the loss/theft.

- If you notice any unauthorised transactions in your statement, inform the bank as soon as possible and within 13 months from the debit dates. If you are required by the bank to report the incident to the police you must do so within 7 days of the request. If you do not adhere to these instructions, or to any other instructions your bank may give you, you might risk not having these transactions reversed.

- As is the case for passwords, one should protect the PIN as if it were his/her house key. A password is personal and should never be divulged to anyone.

Using your card in a shop or at an ATM

Don’t let your cards or your card details out of sight when making a transaction. Ensure that the transaction is conducted in your presence.

- When using your card at an ATM, always take ATM receipts with you.

- When entering your PIN in an ATM or shop, shield the keypad with your spare hand.

- Be aware from any persons offering assistance while using the ATM.

- Put the money away quickly. If you want to count the banknotes, do it quickly while still standing close to the ATM so that your body shields the money from others.

- When you use your cards to make a purchase, make sure that the amount on the transaction voucher produced by the shop for your signature matches the amount of the purchase.

Use of cards over the internet

Nowadays many people use the internet and the new electronic payment methods allow us to buy and sell online. The use of payment cards is very common for distance purchases.

If you intend purchasing on-line, make sure you use safe and reliable sites in order to safeguard your online security, especially your financial information.

-

Always do your on-line shopping from a trusted site rather than choosing a random one suggested by a search engine. If you know the site, it is less likely that you will be ripped off. Check out their after-sales too.

-

Do not keep your passwords, login details and PINs written down.

-

Never give card account numbers over the phone unless you are certain that the person on the other side of the line is reputable.

-

Never respond to e-mails requesting your credit card details. Reputable banks and organisations do not request your personal details by e-mail.

-

Never continue your online purchase using your credit or debit card from a site that does not have SSL (secure sockets layer) encryption installed. You'll know if the site has SSL because the URL for the site will start with HTTPS:// (instead of just HTTP://). An icon of a locked padlock will appear, typically in the status bar at the bottom of your web browser, or right next to the URL in the address bar, depending on your browser.

-

Ensure that you have software that detects the presence of malicious programmes or unauthorised access to one’s computer. Security software (such as an anti-virus programme, firewall) not only protects the computer system itself but also the information stored within. One has to ensure that security software is always active, updated regularly and is capable of scanning files received through e-mail messages as well as those downloaded from internet websites.

-

Ensure that you agree with the amount to be charged to your card when ordering items over the internet. This amount may include shipping, postage, handling and packing fees. Keep copies of all invoices/correspondence indicating the description and cost of the ordered items.

-

Access internet banking or shopping sites by typing the address into your web browser. Never go to websites from a link in an email. Also Beware of spelling mistakes or sites using a different top-level domain (.net instead of .com, for example). These may not be legitimate sites and their intensions may not be genuine. Although the prices on these sites might look enticing, it is their trick to tempt you into giving up your personal and payment details.

-

Use strong passwords when using online shopping websites. Remember that most of the sites save your personal information and card details to make shopping easier and less time consuming. However, if your account is accessed, your personal information would end up compromised. Also make sure you change your password periodically just in case it has been compromised without your knowledge.

-

Do not use online shopping website, or internet banking sites, from internet café’s or public terminals like local council computers. If you do, just remember to log out every time you use a public terminal, even if you were just checking your email. Also beware when browsing using an open Wi-Fi network. If you are in a public space, apart from unauthorised access to your computer you might get someone snooping over your shoulders to get your details.

Most card issuers have provided their customers with a more secure environment in which online payments are conducted. The cardholder provides the card issuer with a valid mobile number. When effecting purchases online, the cardholder will be requested to authorise the transaction by means of a unique passcode (OTP – One Time Password) that will be sent to the cardholder on the mobile number that has been registered at the bank. When the passcode is correctly entered, the cardholder will instantly be confirming that he/she is the authorised cardholder and the purchase will then be completed.

If an incorrect passcode is entered, the purchase will not be completed. This service is meant to provide safe shopping online.

SMS Alert - Monitor your card Transactions

Banks offer an SMS alert service whereby the card user is informed each time his card is used to withdraw cash from an ATM or when particular transactions are done on-line or physically at a shop.

Such a service MAY NOT alert you of ALL card transactions. Sometimes alerts are only sent if the transaction exceeds a specific limit, for example. Furthermore, some banks send an SMS alert for all ATM and online transactions, but only do so selectively for some transactions done in person when buying at retail stores.

Your bank can only send you SMS alerts if it knows your mobile number. You should ask your bank if it offers an SMS alert service and clarify when you should expect to be notified. Some banks offer a free SMS alert service, other may charge a nominal fee. Make sure that you provide your bank with a valid mobile number for each card that you have!

SMS alerts do not substitute your obligations when using cards.

Contactless Cards

A contactless card is a card which allows holders to not need physically insert the cards into any device but simply hold it up to a secure reader.

How does the process work?

Instead of using cash, customers can pay by simply tapping their card on the secure point-of-sale (POS) terminal and the payment is processed instantly and automatically.

Where can I use a contactless card?

Contactless cards can be used in all the shops and business having a POS enabled to contactless payments. You can recognise an enable machine through the symbol below.

Always check that the amount displayed in the POS is the correct one. Once confirmed, just tap your card against the machine. Usually this will emit a signal when the payment is correctly processed.

For small payments, you don’t need to insert the PIN of your cards. For payments which amount exceed 50€, the machine will ask to insert the PIN of your card.

Furthermore, after a number of contactless transactions, you will be asked occasionally to insert the PIN of your card as security measure.

Is this process secure?

In order to process the transaction, the card has to be close to the machine in order to avoid that your card can process the payment of another client.

These cards are extremely secure with a number of controls in place and the latest security technology. This avoids that the same payment is processed more than once.

There is also the same protection against fraudulent transactions as the existing chip and PIN system. As an extra precaution, customers will be asked to enter their PIN from time to time to confirm their identity.

Can I use my smartphone instead of the card?

The most recent smartphones or tablets use a technology called NFC (“Near Field Communication”) which enable payment by tapping the devices on a contactless payment terminal. This means that you can use your smartphone or table instead of the contactless card, with the same features (amount limits and safety). Most of the recent smartphones are enabled for this technology (through services like Apple Pay, Google Pay and Samsung Pay). However, in order to use this feature, the bank issuing the card has to be enabled to the service. More information can be found on your bank website.

Unauthorised Payments

Money can only be taken from your account if you have authorised the transaction. If you notice a payment out of your account which you did not authorise, you should contact your Bank immediately and claim a refund.

In most cases the Bank must refund the payment without undue delay and by the end of the business day following the day on which it became aware of the problem, unless it has reasonable grounds for suspecting that you have acted fraudulently.

Your bank can refuse a refund for an unauthorised payment if:

- it can prove you had actually authorised the transaction. However, your bank cannot simply say that use of your password, card or PIN conclusively proves you authorised a payment;

- it can prove you are at fault because you acted fraudulently or because you deliberately, or with ‘gross negligence’, failed to protect the details of your card, PIN or password in a way that allowed the transaction;

- you told your bank about an unauthorised payment 13 months or more after the date it left your account.

Banks’ Rights to Information on Source of Cash and Deposits

Banks are required by law to ensure that the funds in cash or deposit held by the clients through the bank account are legit. This is required to banks by law in order to prevent money laundering and potential terrorist financing, through the Prevention of Money Laundering Act (Chapter 373 of the Laws of Malta).

What is the bank required to check?

The bank is required to check that the transactions undertaken are consistent with the customer business, risk profile and source of funds (for example, the salary). Usually banks use automated systems to carry out this activity.

Before opening a new bank account, the bank requires prove of the source of income (for example, the employment agreement). Furthermore, the bank may ask from time to time to provide updates on the source of income (for example, recent payslip, documents showing the sale of personal assets, loan agreements, etc).